Do You Have What It Takes To Be A Professional Option Trader?

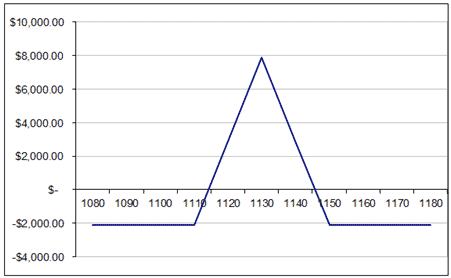

Q1. Which of the following two positions has higher gamma risk?

Current Price: $1130

Trade Details: RUT 15 Day Call Butterfly Spread

Buy 5 RUT June 12th $1110 calls @ $31.00

Sell 10 RUT June 12th $1130 calls @ $16.90

Buy 5 RUT June 12th $1150 calls @ $7.00

Premium: $2,000 Net Debit

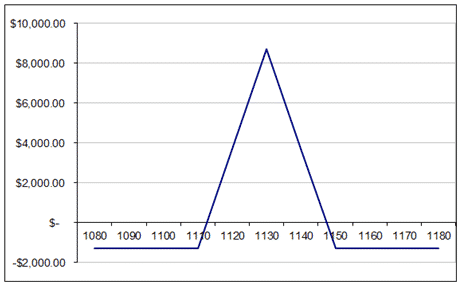

Current Price: $1130

Trade Details: RUT 50 Day Call Butterfly Spread

Buy 5 RUT July 17th $1110 calls @ $42.50

Sell 10 RUT July 17th $1130 calls @ $28.90

Buy 5 RUT July 17th $1150 calls @ $17.90

Premium: $1,300 Net Debit

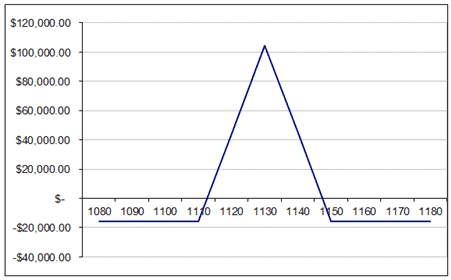

Q2. Which of the following two positions has a higher gamma risk?

Current Price: $1130

Trade Details: RUT 50Day Call Butterfly Spread

Buy 60 RUT July 17th $1110 calls @ $42.50

Sell 120 RUT July 17th $1130 calls @ $28.90

Buy 60 RUT July 17th $1150 calls @ $17.90

Premium: $15,600 Net Debit

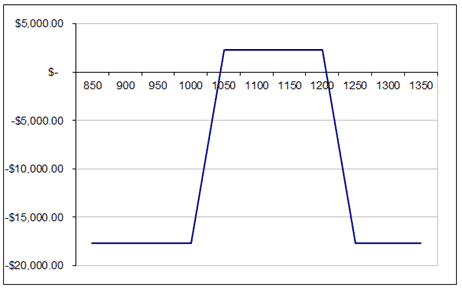

Current Price: $1130

Trade Details: RUT 50 Day Iron Condor

Buy 10 RUT July 17th $1000 puts @ $3.20

Sell 10 RUT July 17th $1020 puts @ $4.20

Sell 10 RUT July 17th $1210 calls @ $2.25

Buy 10 RUT July 17th $1230 calls @ $0.95

Premium: $2,300 Net Credit. $17,700 Capital at Risk

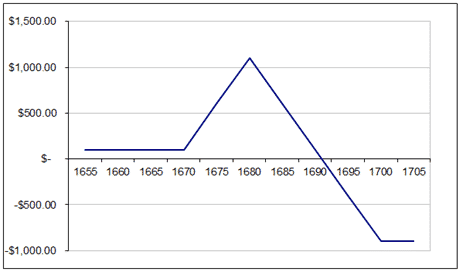

Q3. What is this strategy called?

Q3. What is this strategy called?

Q4. In which of the following scenarios can European options be exercised early:

– A dividend is payable

– There is a stock split

– Bankruptcy

– None of the above

Q5. Buying an at-the-money call and selling an at-the-money put is equivalent to:

– Long stock

– Long straddle

– Short stock

Q6. You are short a naked 1140 RUT call that you sold for $2.00. The call expires on Thursday June 19th. On Thursday, RUT closes at 1145. On Friday, RUT opens at 1148.

How much did you lose on the trade?

Q7. What is the following strategy called?

– Long 100 shares, Short 1 OTM call, Long 1 OTM put

Q8. Selling 3 delta iron condors is an attractive risk/return proposition?

– True

– False

Q9. Buying and holding VXX is an excellent way to protect against a market crash

– True

– False

Q10. List the relevant volatility index for the following products

– RUT

– SPX

– NDX

– AAPL

– GLD

Check The Answers and Tally Your Score:

https://optionstradingiq.com/option-trader-test-answers/