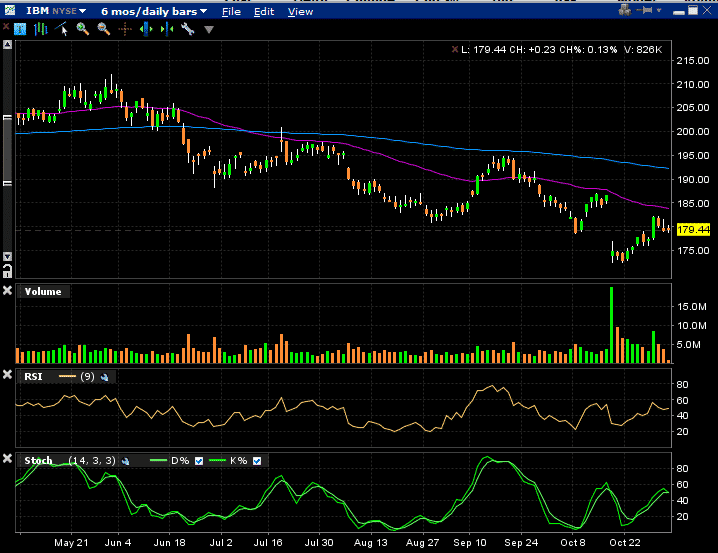

November 1st 2013 – IBM Gamma Scalp – Opening Trade:

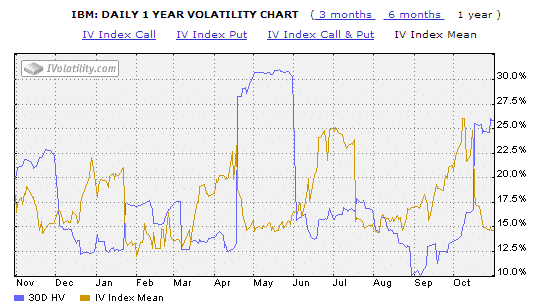

Trying something new here, a gamma scalp trade on IBM. Implied volatility is very low, so the straddle is cheap to buy. I will buy and sell shares once delta gets to +/- 30 in order to get back to delta neutral.

As IBM rallies, I will get long delta meaning I will need to sell shares. As IBM falls I will have negative delta meaning I will have to buy shares. So I will be buying low and selling high.

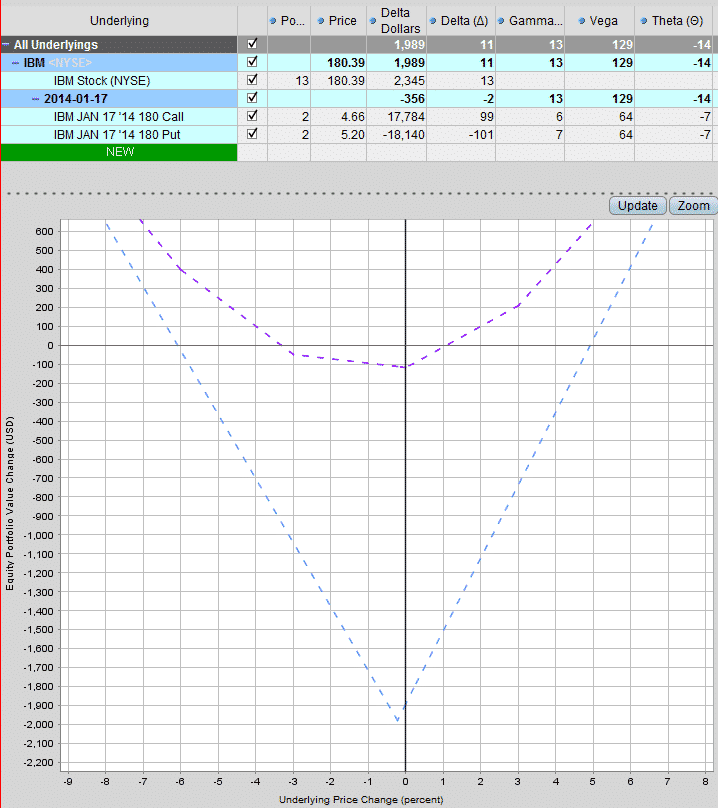

November 4th 2013 – IBM Gamma Scalp – Update:

IBM has rallied to $180.39, P&L is $40 and delta is +11.

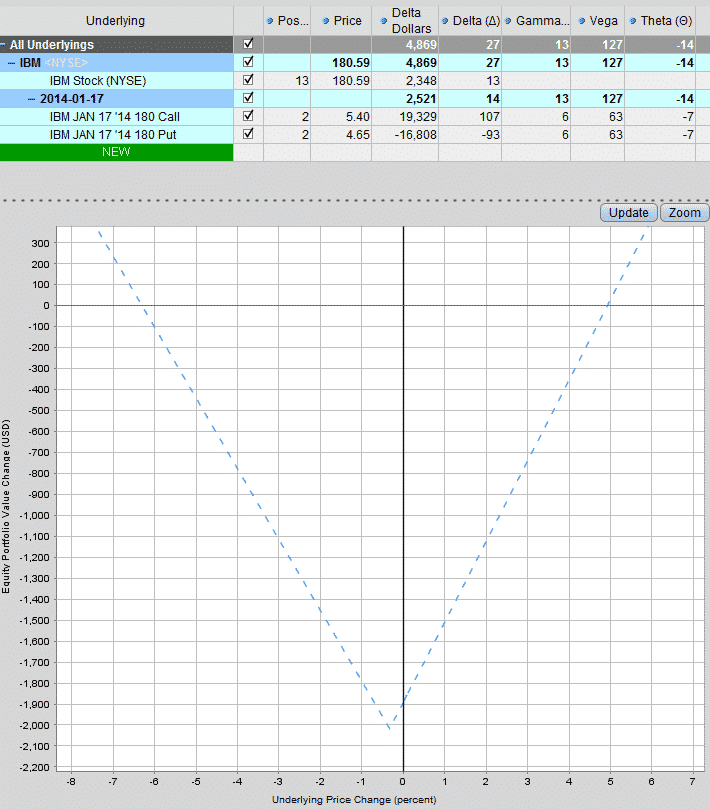

November 7th 2013 – IBM Gamma Scalp – Adjustment:

Delta on the IBM trade had risen to 29, so I sold 29 shares to get back to a delta neutral position which is -13 shares. So far sitting on $42 in P&L.

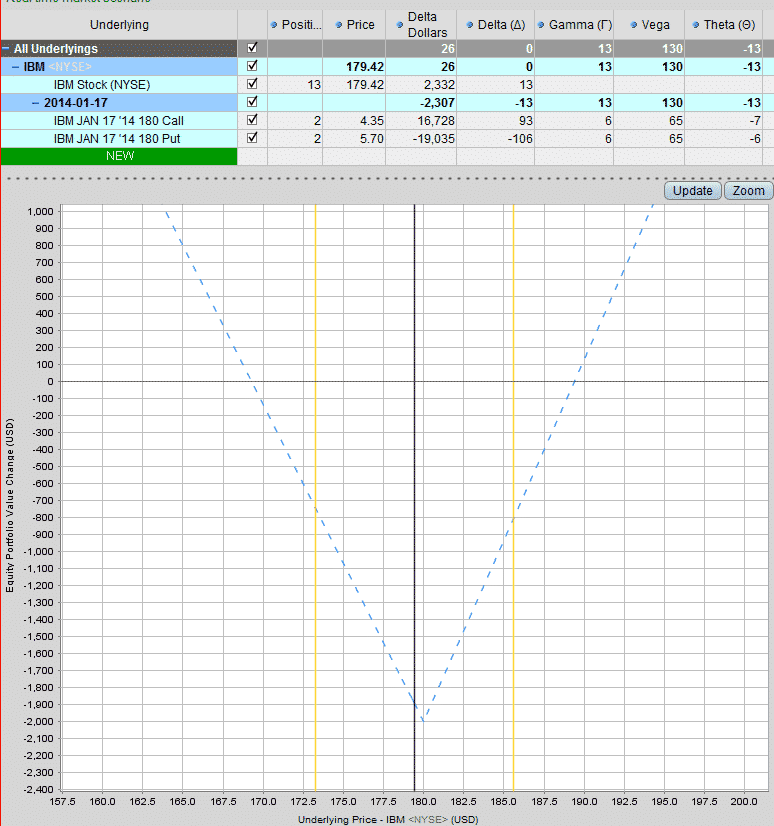

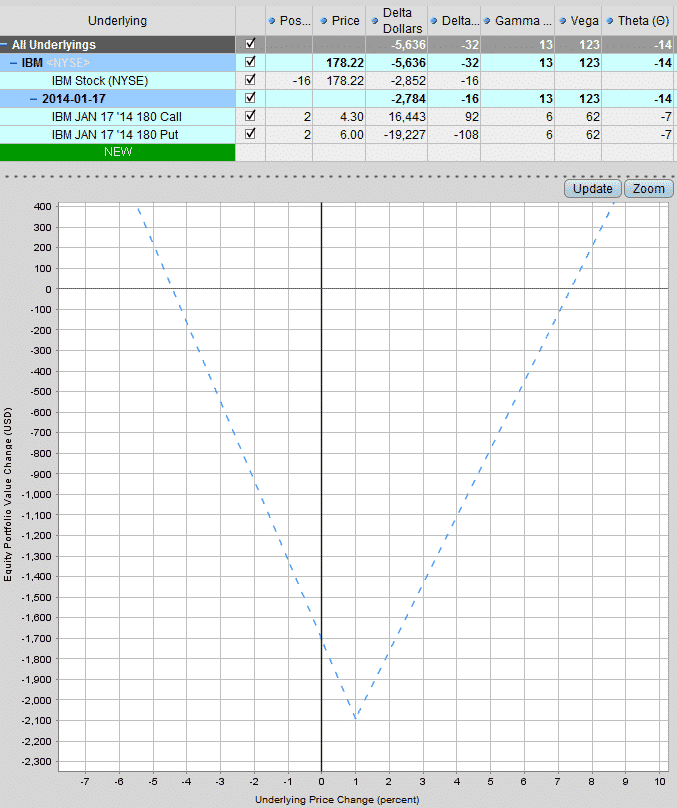

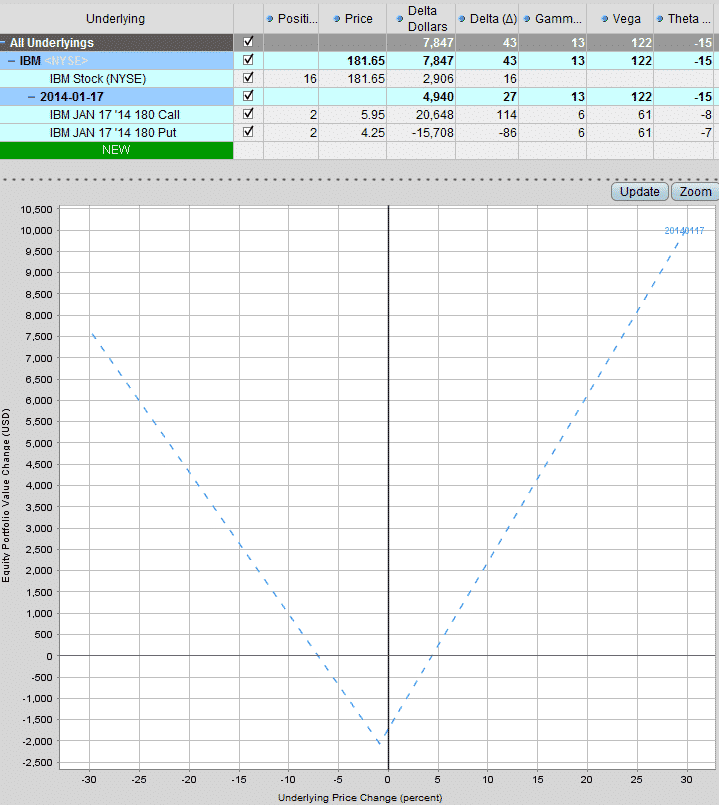

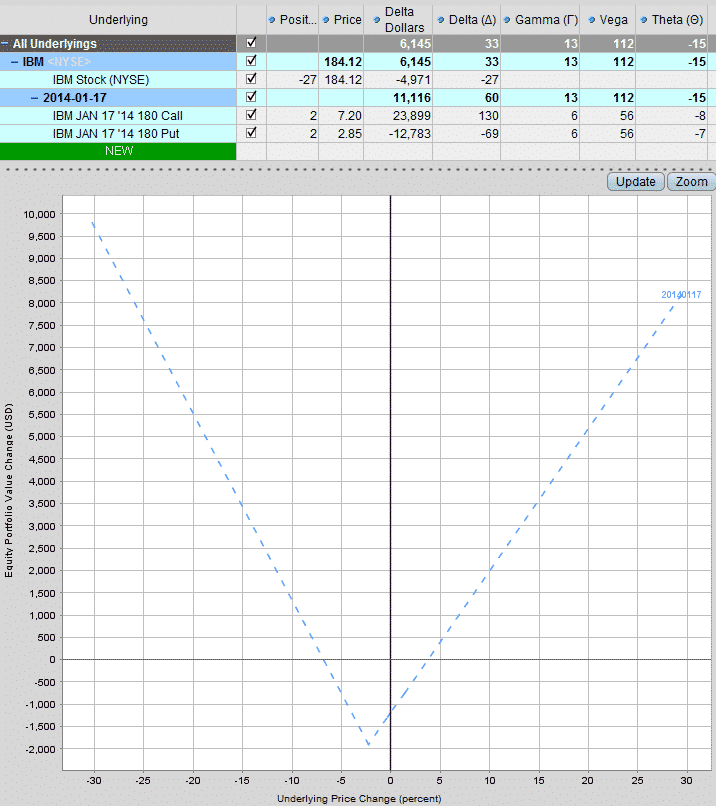

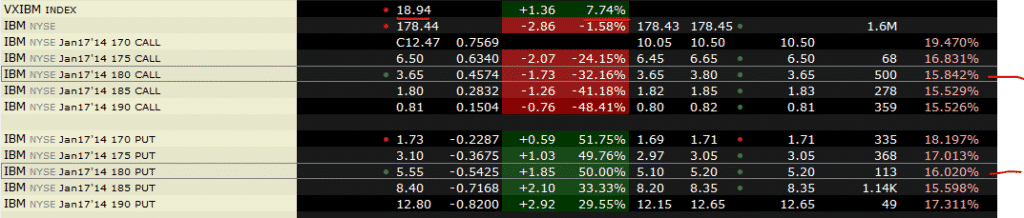

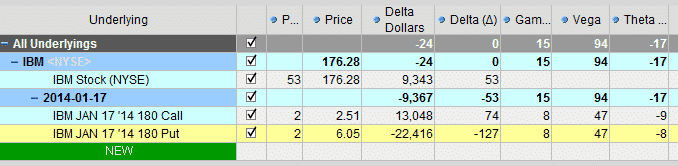

BEFORE ADJUSTMENT

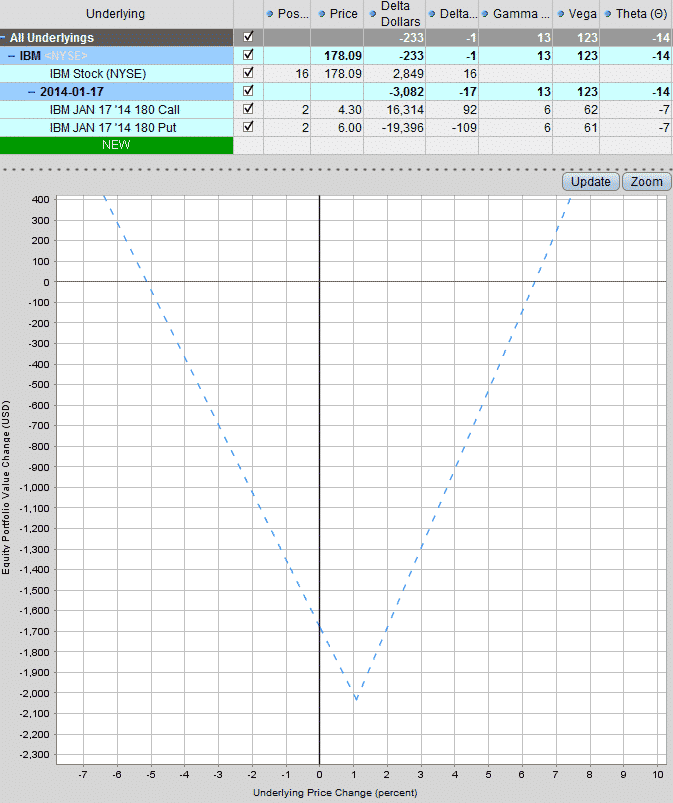

AFTER ADJUSTMENT

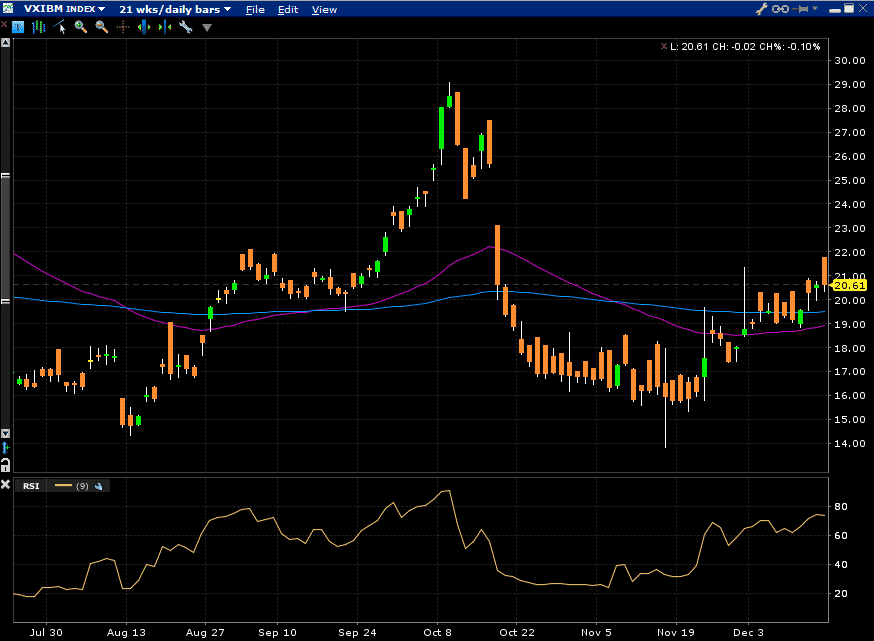

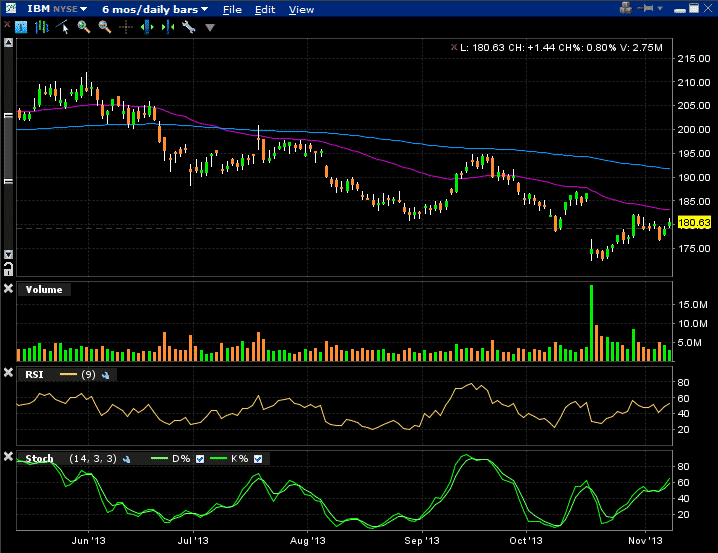

CHART

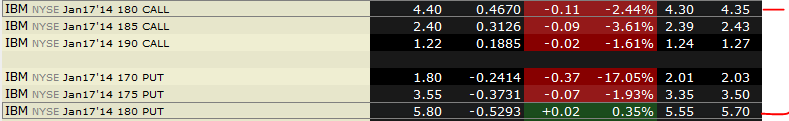

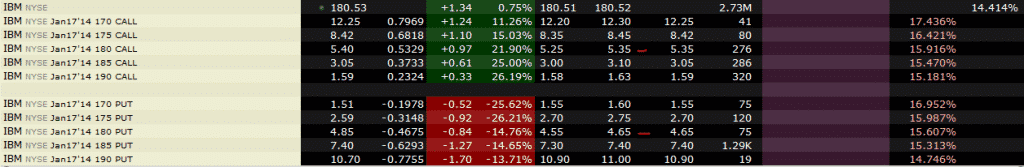

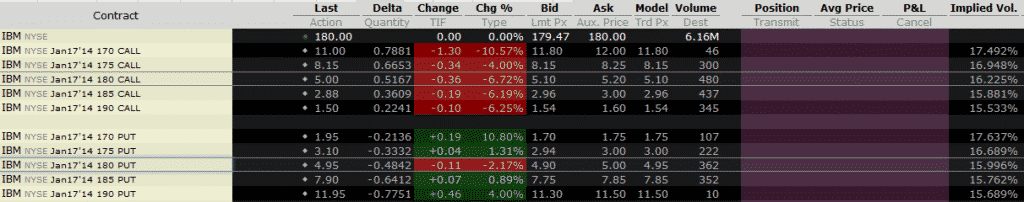

STRIKES

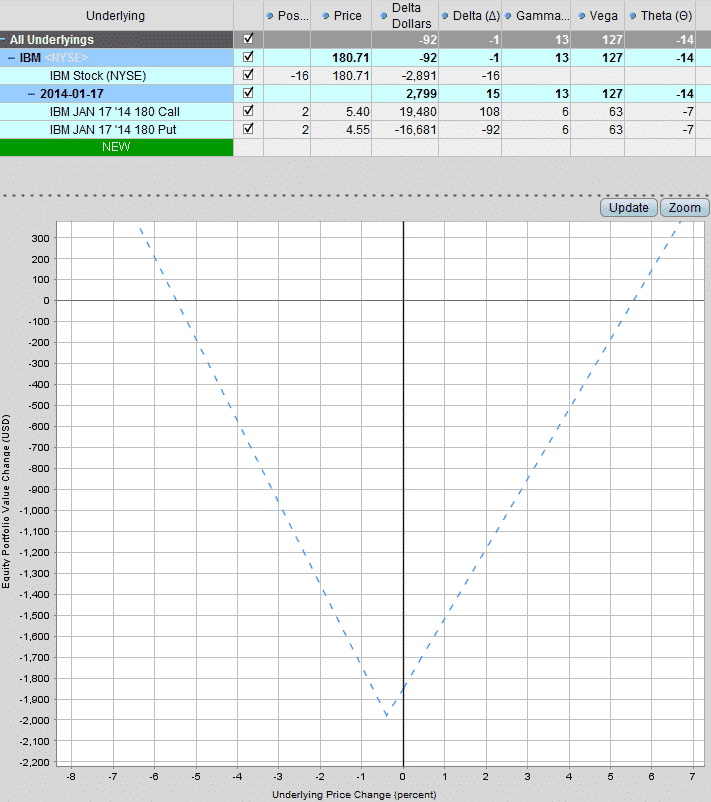

November 8th 2013 – IBM Gamma Scalp – Adjustment:

Delta hit -32 today, so buying 32 to shares to get back to delta neutral.

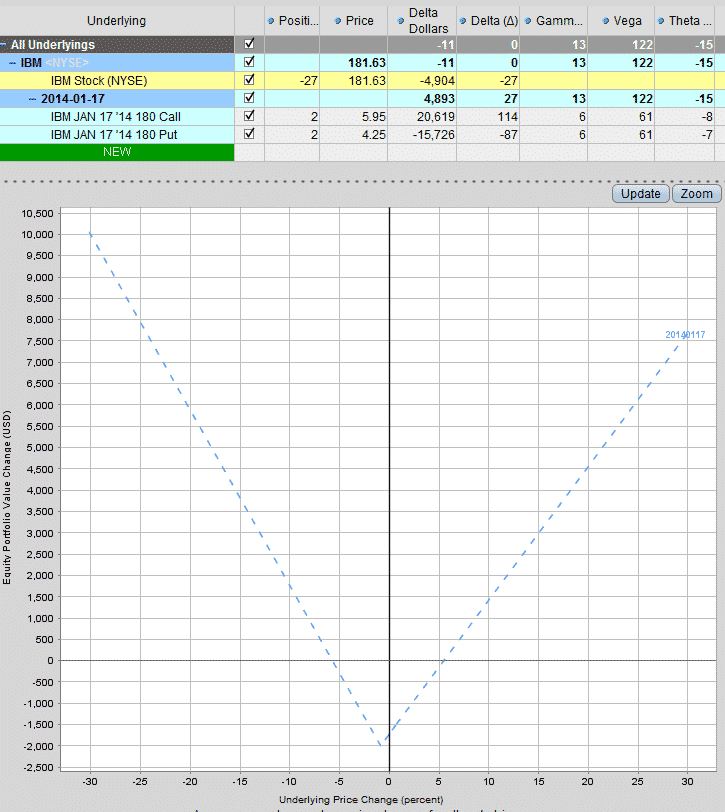

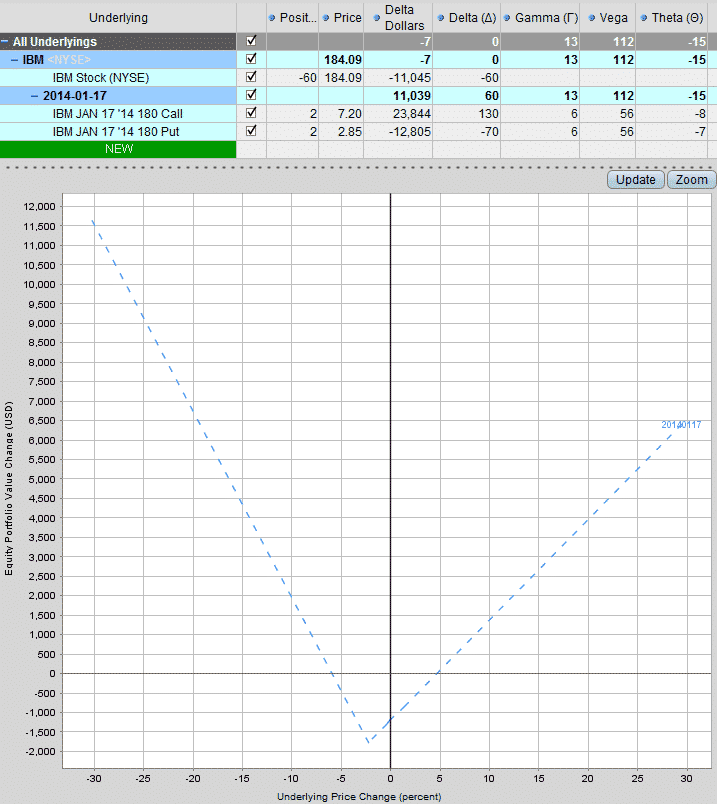

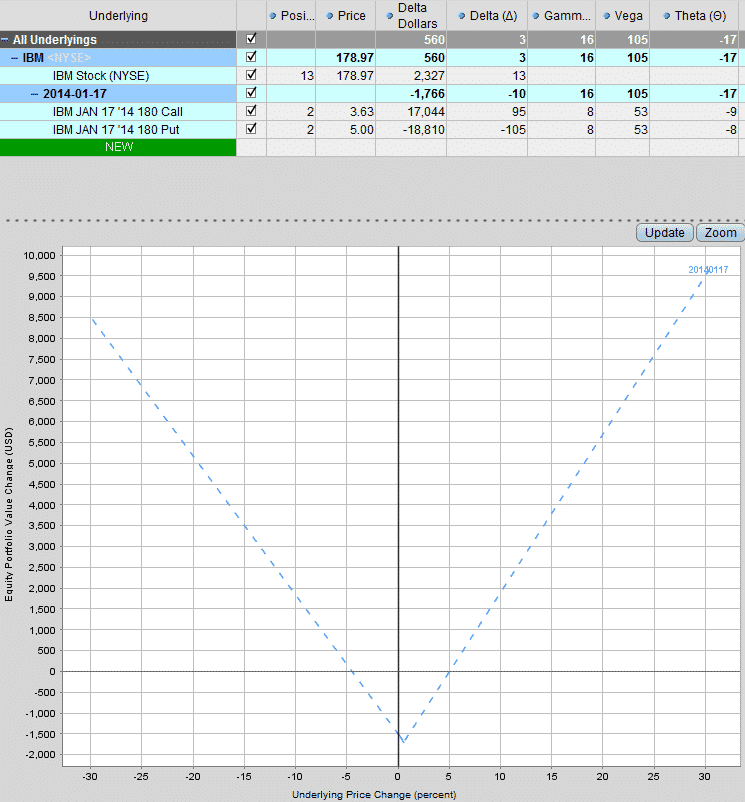

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

STRIKES

Current P&L: $57 at end of day

November 11th 2013 – IBM Gamma Scalp – Adjustment:

IBM is up 1% today and delta has hit +43 so selling 43 shares at $181.65.

Current P&L: $82

November 18th 2013 – IBM Gamma Scalp – Adjustment:

IBM has risen and delta is 33, so I’m selling another 33 shares to get delta back to zero

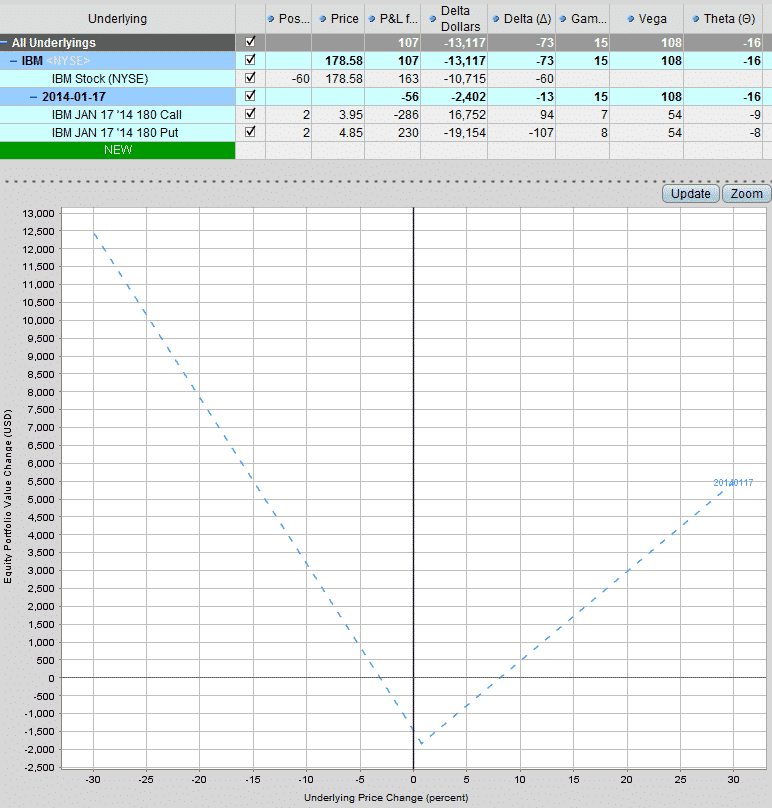

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

Current P&L: $32

November 19th 2013 – IBM Gamma Scalp – P&L Update:

Current P&L: -$76

November 21st 2013 – IBM Gamma Scalp – P&L Update:

Current P&L: $73.

November 25th 2013 – IBM Gamma Scalp – Adjustment:

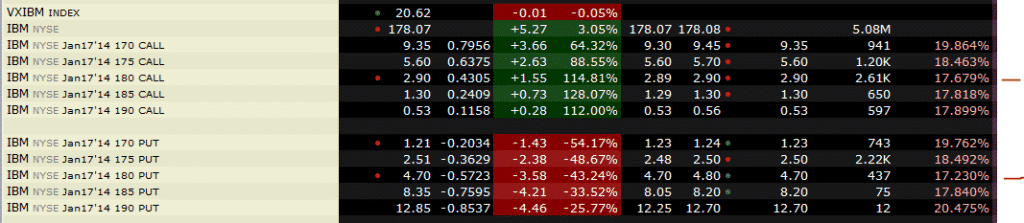

IBM opened down 1.5% this morning and VXIBM has shot up 7%, this has really helped this trade. IBM is now back down near the centre of the straddle and as we were short 60 shares, the selloff has helped. The spike in vol has helped increase the value of the straddle.

Buying 73 shares @ $178.58 to get back to delta neutral.

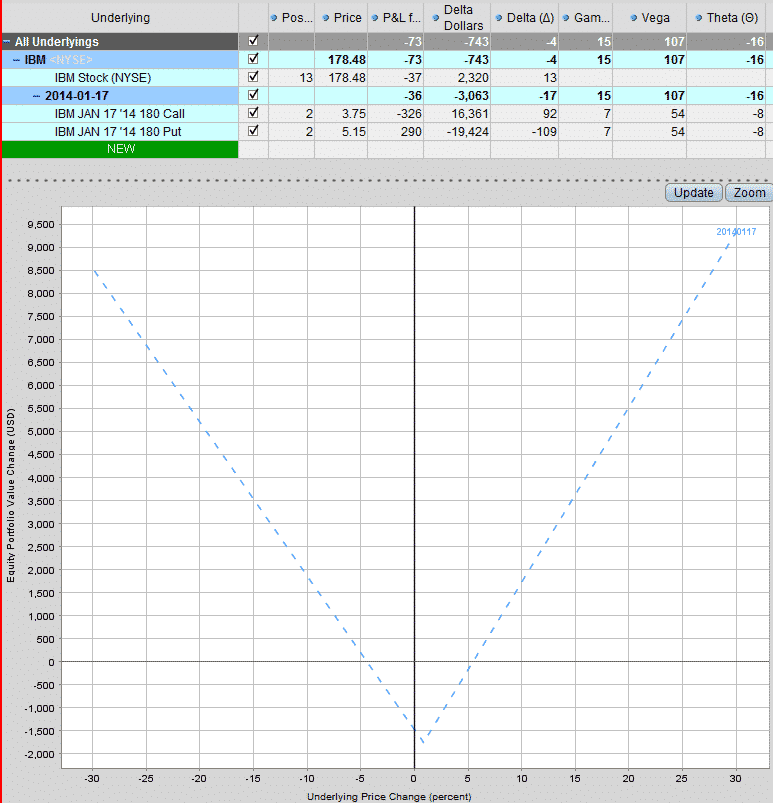

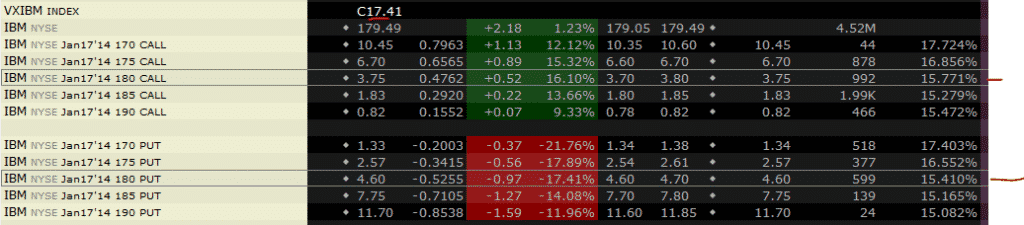

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

November 28th 2013 – IBM Gamma Scalp – P&L Update:

This trade continues to perform well as IBM heads back towards the centre strike.

December 3rd 2013 – IBM Gamma Scalp – Adjustment:

With the selloff of the last few days delta has hit -40. Buying 40 shares @ $176.25 to get back to neutral.

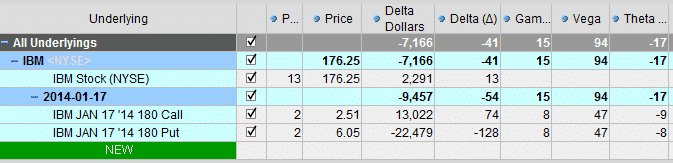

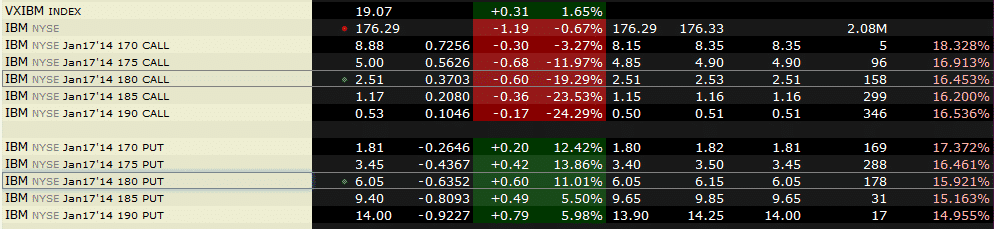

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

December 5th 2013 – IBM Gamma Scalp – Update:

December 13th 2013 – IBM Gamma Scalp – Adjustment:

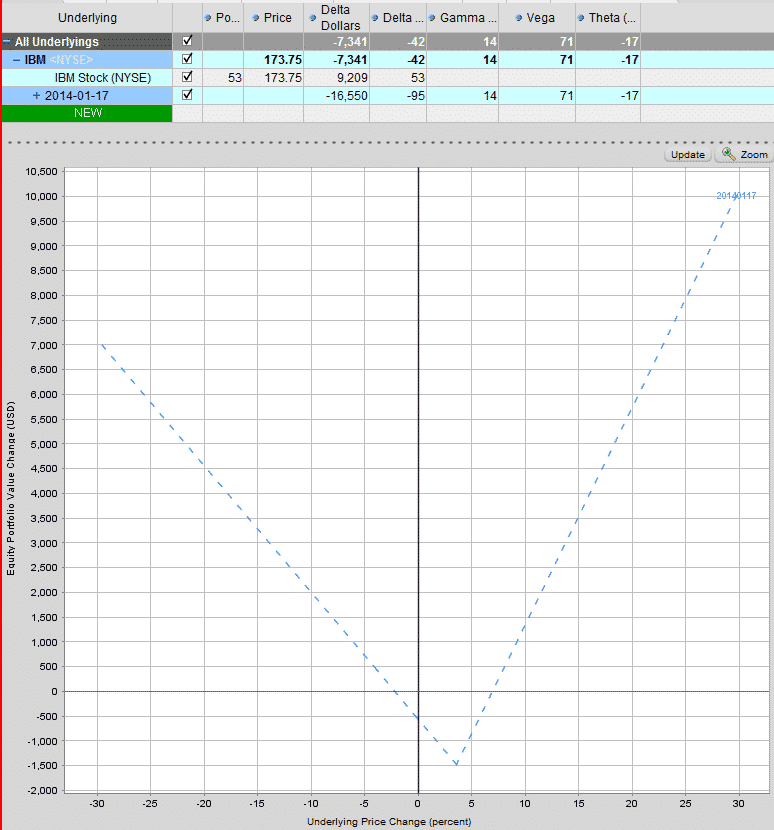

Delta is at -42 so buying 42 shares @ $173.75

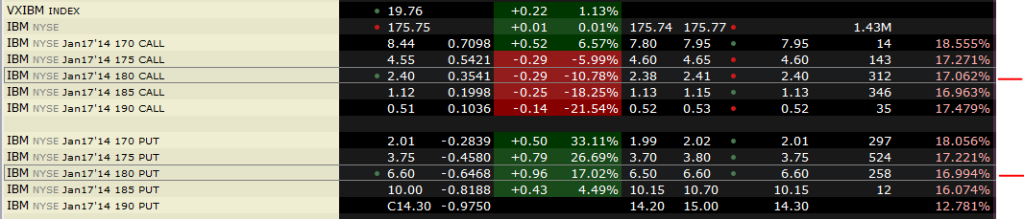

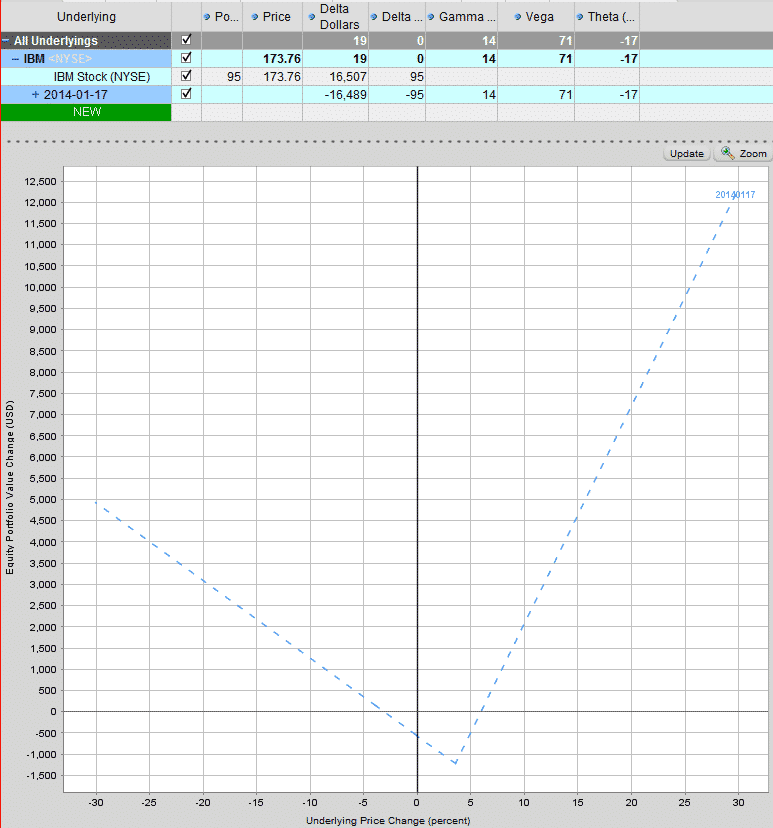

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

December 16th 2013 – IBM Gamma Scalp – Adjustment:

Markets are shooting higher today and IBM has popped up 3.11%. This is fantastic for this trade considering we were long 95 shares and the pop has taken us back close to the centre of the straddle. As an added bonus, IV is steady today and has really shot higher over the past week.

The net delta on the gamma scalp is 66, so I’m selling 66 shares @ $178.15.

Current P&L: $144.41. Taking profits here

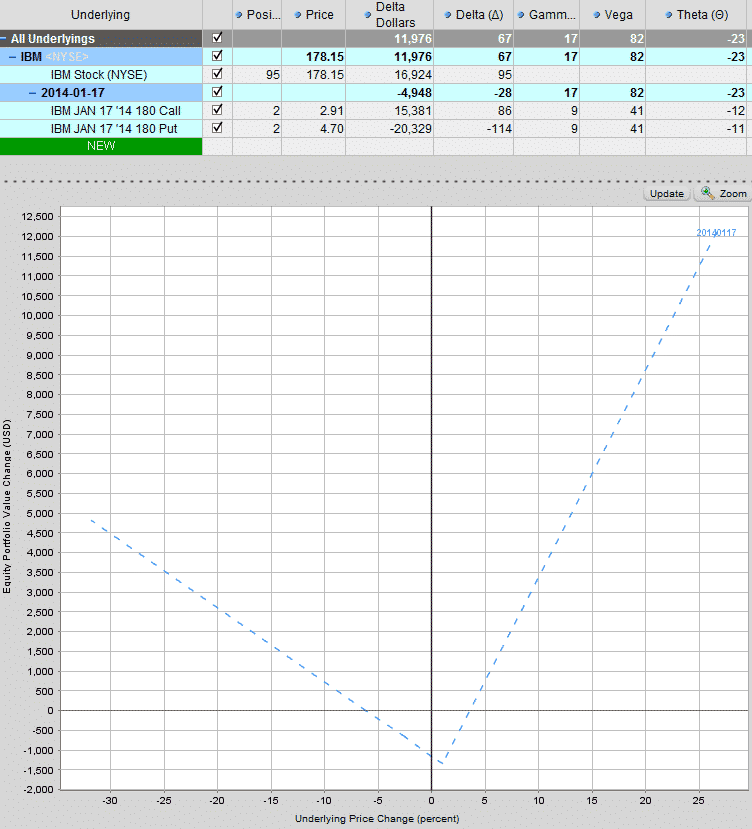

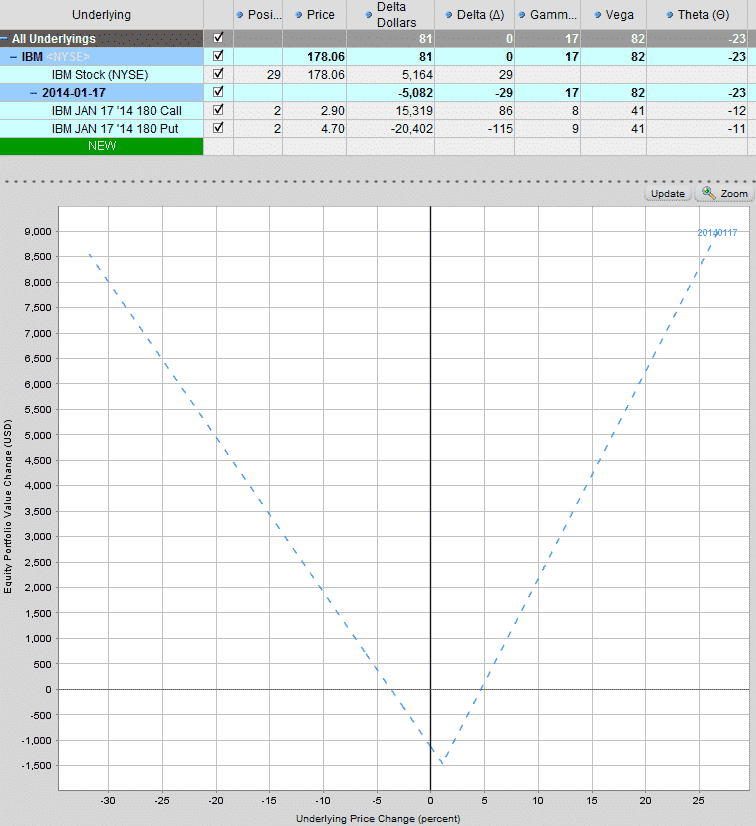

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

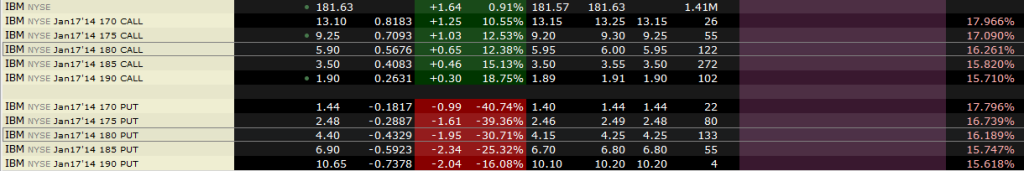

STRIKES

IBM VOLATILITY