Welcome to Module 3 of the Options Trading IQ Iron Condor Course.

To make money in the stock market you always need to take some sort of risk.

Unfortunately, anyone who tries to convince you there is a money tree in the stock market is lying.

Unless of course you are the Federal Reserve! While Iron Condors are a conservative options strategy, they are not risk free.

This section will discuss some of these risks.

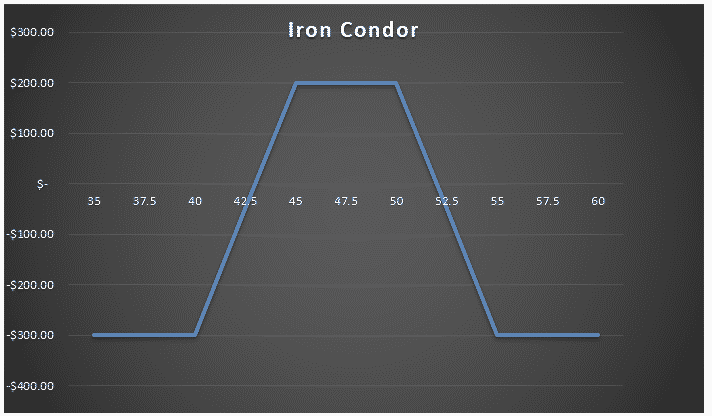

The foremost risk of Iron Condors is that the risk to reward ratio is low.

Therefore, in the event of market turmoil, it is possible to lose substantially more than the premium collected.

As an example, a typical Iron Condor trade might produce $200 in income but have $800 of capital at risk.

This may seem unappealing at first. Despite this it is important to remember that Iron Condors have an extremely high probability of profit.

While Iron Condors do have the opportunity for larger losses, they are far more conservative than other short volatility options such as short straddles and strangles.

These strategies also collect income and have a similar exposure to the greeks but have unlimited tail risk.

While a short strangle does allow an investor to collect more premium they have no downside protection for when things go wrong.

Think of it this way. As an options seller you get paid like an insurance provider.

An investor who uses Iron Condors to generate income provides the service of comprehensive insurance.

Yet they know that in the event of a natural disaster they too need to be protected.

So, they walk down the street and buy a cheaper form of insurance to make sure that in the worst-case scenario they still have a house themselves.

Iron Condors have a Greek profile that is like other short options strategies. They are short vega (or the level of implied volatility) and long theta (time value). Therefore, they will make money when nothing happens or the expectation for nothing happening in the future increases.

In contrast, Iron Condors lose money if a large move does happen, or the expectations for a large move increase into the future, driving up the implied volatility.

The reason why money is lost in both these situations is it is now more likely that at expiration the stock will be outside of the Iron Condors body and profit zone.

While the structure is delta neutral on inception, after the stock moves, we take on delta exposure, essentially, we want the stock to go back to where it was.

This risk of our changing delta is known as gamma.

Despite these risks Iron Condors still offer a great way to take advantage of selling options without the tail risk of other short options strategies.

Over long periods of time this insurance premium will always exist, therefore making Iron Condors a good candidate for a profitable, long term strategy.

In Module 4, we’ll be looking at the best ways to enter and exit iron condors.