In Module 8 of the Iron Condor course, we will be looking at one of my favorite variations on the iron condor – a “Mouse Ear”

As iron condors are inherently short Vega, low volatility environments can be especially risky for iron condor traders.

A quick spike in volatility can put your condor under pressure very early in the trade and make it difficult to adjust and end with a profit.

In addition to a volatility spike, a sustained rally, with very few pullbacks can also cause problems, slowly eating away at your iron condor, until you are forced to take a loss or look for an unattractive adjustment opportunity.

The problem with adjusting the call side in this environment is that with volatility so low, the typical methods of rolling up and / or out are unattractive at best and precarious at worst. With volatility so low, you simply cannot generate enough premium to make the roll worthwhile.

So, what are we to do?

You could stop trading and wait for high volatility to return, but who among us is able to sit idle for 3-4 months?

You could try new strategies, but that is also fraught with danger if you do not have the necessary experience and expertise.

What if there was a better way to trade iron condors in low volatility environments?

Well, there is, and despite the funny name, they are a great way to trade condors during low volatility periods.

Let’s take a look at a “Mouse Ear” iron condor.

MOUSE EAR IRON CONDOR

I like to think of a mouse ear iron condor as a lower risk, lower return version of a condor. BUT, it also has the added benefit of a significant “profit tent” around the short strike.

No longer do you have to fear a stock moving towards your short strike.

With a mouse ear, if it doesn’t occur too early in the trade, you welcome it!

Mouse ears may look complicated, but they are actually very easy to set up, albeit a little commission intensive.

This type of trade will also significantly reduce your Vega exposure which is exactly what you want when the VIX is near a 6 year low.

Trade Setup:

Here is how the trade is setup:

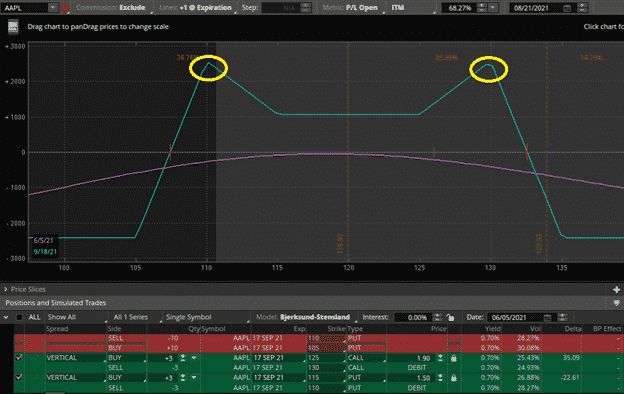

Strategy: Apple Iron Condor – AAPL

Current Price: $120

Trade Set Up:

Sell 10 AAPL 130 calls, Buy 10 APPL 135 calls

Sell 10 AAPL 110 Puts, Buy 10 AAPL 105 puts

Premium:

$2,090 Net Credit for the iron condor.

Total Capital at Risk: $2,910

Potential Return: 41.8%

Now add the ears:

Buy 3 APPL 125 CALLS, Sell 3 AAPL 130 calls.

Buy 3 APPL 115 Puts, Sell 3 AAPL 110 Puts.

Premium: -$1,020 Net Debit for the ears.

$1,070 total premium received.

Total Capital at Risk: $2430

Potential Return: As high as $2,567. Most likely around $1,070 (original premium received).

You can see above that by adding a debit spread just in front of the short strikes gives the payoff graph the appearance of having “ears”.

I have used a ratio of 3 debit spreads for every 10 iron condors, but you can play around with the numbers and see what works for you.

You might prefer to only trade 2 debit spreads, or even just 1.

Even though this strategy has a potential for a higher return if the underlying expires in the profit zone, you should be aware that it will be fairly unlikely as the profit zone is quite small. It might happen a couple of times per year, but certainly not every month.

Keep in mind also that you are trading 6 different strikes instead of 4, so slippage and commissions could eat into the return.

The main benefit of a mouse ear condor is that you will lessen the damage in the event of a sharp market move.

You can see this via the different greeks.

How is a Mouse Ear affected by Changes in Implied Volatility?

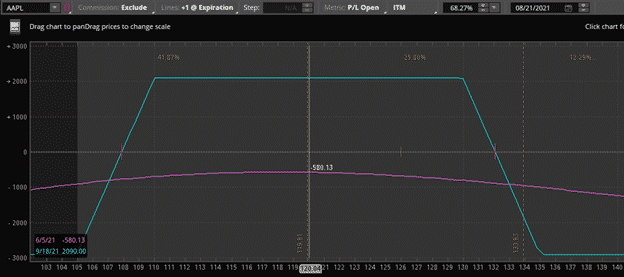

Above I said that a mouse ear can provide a useful alternative to an Iron Condor in times of low volatility.

This is because the Mouse Ear Condor has less Vega than the Iron Condor.

To simulate this I have used the same trades above but increased the implied volatility by 10 points.

Below we can see the standard Iron Condor with the instantaneous P&L line in purple.

We can see that with this vega change we have instantaneously lost $580.13.

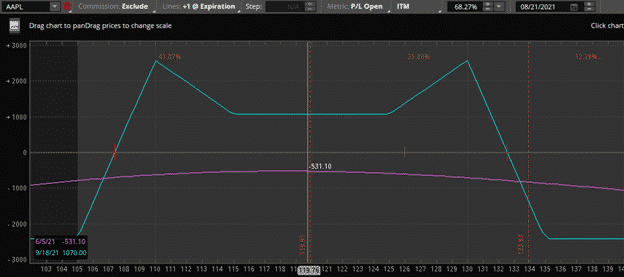

Now let’s look at our Mouse Ear Condor.

We can see that the Mouse Ear Condor also loses from the rise in implied volatility but loses slightly less.

Down $531.10.

Even better as the trade nears expiration the effect of a move in implied volatility will effect the Mouse Ear Condor less and less.

All while doing so we have a small opportunity for an outsized profit if stock closes at one of the “ears” at expiration.

So give it a try! But remember to paper trade it first! In Module 9, we will be looking at how to deal with early assignment

In Module 9, we’ll be looking at how to deal with early assignment.