Welcome to Module 5 of the Options Trading IQ Iron Condor Course. Today we’re looking at how to select your strikes prices for your iron condor trades.

There are number of different factors you could take into consideration when choosing strikes on your iron condor trades.

Some people tend to over analyze and are overcome with analysis paralysis.

Others try to take a rules based approach and take the emotions out of the decision making process.

For those suffering from the dreaded analysis paralysis, let’s see if we can come up with some pretty standard rules for iron condor entry.

Probability of Success

One of the easiest ways to decide which strike prices to choose is to look at the delta of the short options.

As a rough guide, you can use delta to estimate the probability of success.

Assume your short call strike has a delta of -0.10 and your short put strike has a delta of 0.10, you have basically set up an iron condor with an 80% probability of success.

Admittedly this is a fairly simplified way of looking at things, but it is a good rule of thumb.

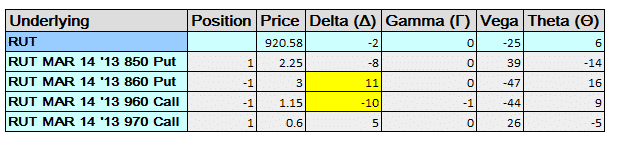

This is a neutral iron condor that has a roughly 79% probability of success:

Days to expiry

Typically iron condor traders want to make the most of time decay which means trading shorter dated options.

However, a lot of beginners get sucked into trading weekly iron condors which are much riskier than they realize.

They don’t call expiration week “gamma week” for nothing. Generally the sweet spot for iron condors is anywhere between 30 and 60 days to expiry.

When deciding on a timeframe, just know that longer dated trades will allow you to get further away from the current price for the same amount of premium, but you will be required to stay in the trade longer in order to make the full profit.

Therefore, you could say there is increased risk of the market making a large move during the course of your trade.

In general, a large market move will have a slightly lower P&L impact on a 60 day iron condor than a 30 day iron condor which is something else to keep in mind.

Like everything in life, it’s a trade off and something that you will only figure out what works best through trial and error.

Each trader will be different.

Standard Deviations

While not one of my preferred methods, you can also use standard deviations to work out your strike placement.

The argument here is that if you are 1 standard deviation away from the market, you have a 68% probability of success and if you are 2 standard deviations away you have a 95% probability of success.

This is definitely something to be aware of, but certainly not essential. You can download a standard deviation calculator here.

Legging in

In order to reduce the risks, some traders may choose to enter half or one third of their position, then wait a few days and enter the remainder.

This way if the market makes a big move after the initial trade, you don’t take the full hit and can then benefit from the increase in implied volatility.

Another way of legging in is to sell one side of the iron condor first and then wait before entering the second side.

If a trader thought they market was due to rally, he could enter the put credit spread first, wait a few days and then enter the call credit spread.

Of course the risk is that the market moves against your initial trade leaving you in a difficult position, so legging in this way does take some experience and is not without its risks.

Summary

There are many different ways to trade iron condors and many different rules you can come up with.

Some traders thrive on a rules based approach while other prefer a “freestyle” trading method.

For those who prefer rules based trading, deciding on entry rules based on delta and time to expiry is a great place to start.

In Module 6, we’ll be looking at how to adjust trades once they get in to trouble.