These days it seems like there are a lot of companies getting rocked by the Amazon juggernaut.

Walgreens Boots Alliance is the latest stock to get hammered dropping from $84 to $69 in recent weeks, a decline of 17.8%. The stock is currently at the lowest levels seen since December 2014.

Short interest in the stock has jumped from 9.5 million shares to 21.6 million shares since July.

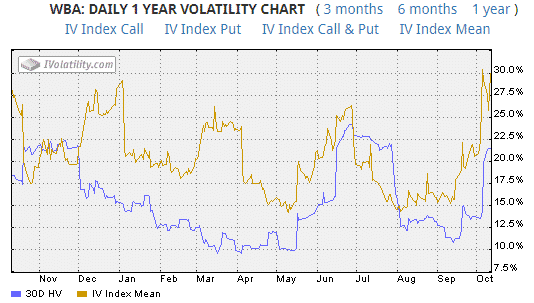

Implied volatility has doubled, jumping from 15% to 30%. The Relative Strength Index is at a 5 year low of 17.51.

All looks pretty bearish really, but the contrarian in me says there might be some opportunity here.

According to a recent article on Market Watch:

“After transforming such industries as publishing, consumer electronics and cloud services — and decimating key players along the way — Amazon has built a reputation for dominance.

But part of the wide interest in an Amazon pharmacy is that the highly regulated drug business has never been particularly transparent. At best, U.S. drug pricing is complex; at worst, it’s dysfunctional.

Those who are skeptical of Amazon’s potential pharmacy entry have noted Amazon’s difficulty breaking into highly regulated markets, including alcohol distribution in the U.S.”

Download the Implied Volatility Calculator

CNBA first reported in May that Amazon was planning a move into the pharmaceutical industry, even though no mention of this has been made by the company. Some are expecting an announcement before thanksgiving. So the earnings call set for late October will be widely anticipated.

WBA is currently trading at 18x trailing and 12.5x forward earnings which seems pretty good, although it could drop a little further before stabilizing.

In cases such as this, I like put ratio spreads. They can be set up with zero risk on the upside, or even a small income potential, with a large profit zone and breakeven point on the downside.

Ultimate Guide to the Stock Repair Strategy

Otherwise a pure vol play would be to trade a short strangle to take advantage of the high levels of implied volatility. This type of trade would require the stock to stay within a specified range over the course of the trade.

Bullish traders could try either a cash secured put or a put credit spread.

Let me know in the comments if you’re planning a trade in WBA.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Despite volatility being high, the Nov options aren’t priced very attractively for spreads. January is a little better… but not much.

Yeah I went with the Jan’s as well. Working out ok so far but nothing spectacular. Waiting for time decay to do it’s thing.

Gav, I already have done a trade in Walgreens. When they quit selling cigarettes, I quit going to Walgreens for anything including their “other” drugs that they continue to sell. May they rest in the dustpan of AMZN.

Unfortunately, I jumped in way too soon on WBA and on 10/6/17, I Sold-to-Open 10 contracts of the WBA 11/24/17 $72.50 Naked Puts for $1.69 credit. The 10/13/17 session closing mid-point was $6.00 credit and WBA closed at $67.56 so I’m a hurtin’ pup, for sure! 🙁

Damn! What’s your plan going forward?

Hi Gavin,

Nice post about WBA. I like how you incorporate the vol charts along with the daily stock chart.

WBA is certainly on our radar at The Smart Option Seller. It’s very tempting to sell naked puts on it (that’s what we do) but not sure we’ll jump on it yet. We look to sell puts another 20%-30% below the already low stock price.

Keep up the good work!

Cheers.

Lee Lowell