Today, we’re going to take a details look at trading credit spreads for a living and discuss a really simple method that you can use to get started right away.

A credit spread is a generic term used to describe an option strategy the involves selling a call or put and then buying a further out-of-the-money call or put.

The two types of credit spreads are Bull Put Spreads (bullish trade) and Bear Call Spreads (bearish trade).

You can then combine those two strategies to form and Iron Condor (neutral trade).

In this article, we’ll look at trading credit spreads for a living including a full trading plan with rules related to position size, trade entry and trade management.

Read on to learn more….

Contents

- Trading Credit Spreads For A Living

- 3 Types Of Credit Spreads

- Combining 2 Credit Spreads To Create An Iron Condor

- How To Start Trading Credit Spreads For A Living

Trading Credit Spreads For A Living

Options give you the right but not the obligation to buy (call) or sell (put) a stock at a specified price.

If you’re new to options, you should read this post first.

When starting out with options, a lot of traders will be drawn to selling puts or covered calls, but these strategies have a lot of risk and tie up a lot of capital.

Trading credit spreads allows traders to more effectively utilize their capital because they are risk defined trades and allow for a better return on capital.

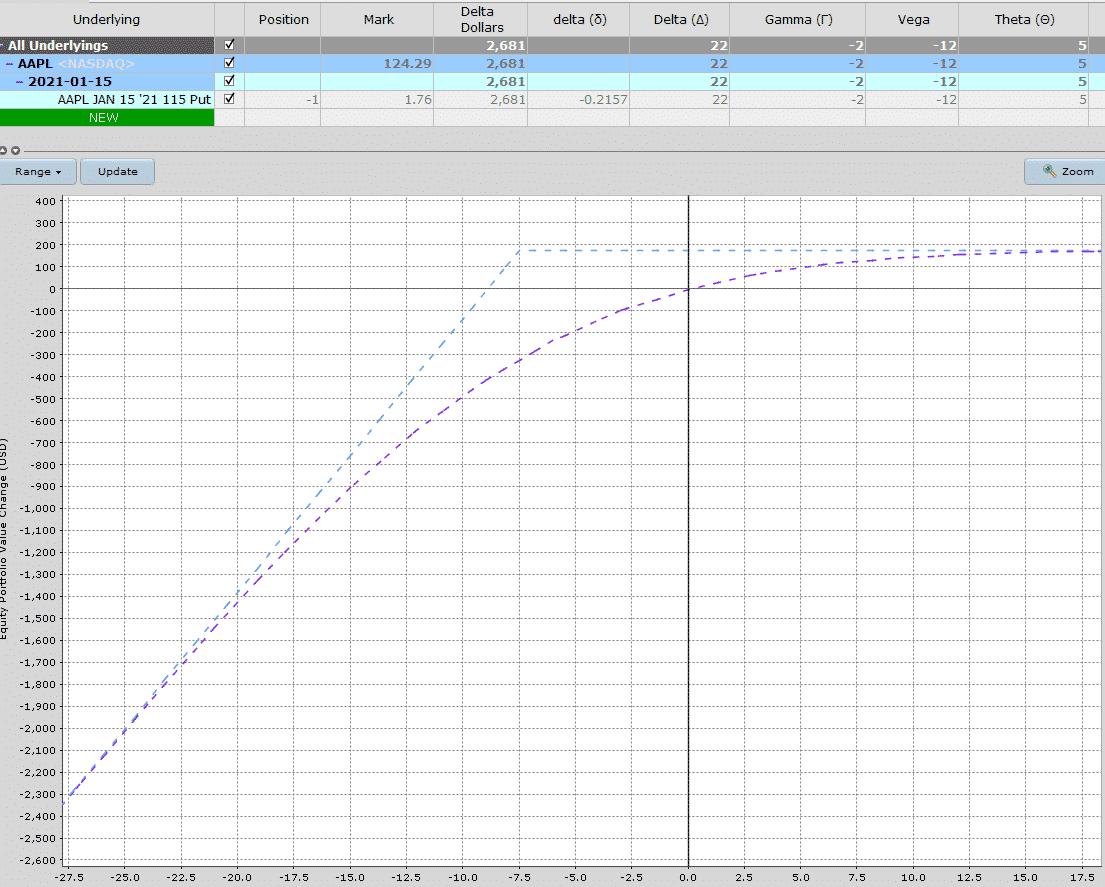

Let’s take a look at an example using AAPL and assume the trade is bullish and looking to generate some income from selling put options.

Date: December 8th, 2020

Underlying Price: 124.30

Strategy: Cash Secured Put at 20 Delta

Sell 1 AAPL Jan 15, 2020 115 Put @ 1.76

Max Profit: $176

Capital At Risk: $11,324

Return Potential: 1.55%

This trade is risking $11,324 for a potential return of $176 which equates to a 1.55% return on capital.

Now, let’s look at trading a credit spread rather than a naked / cash secured put.

Date: December 8th, 2020

Underlying Price: 124.30

Strategy: Bull Put Credit Spread at 20 Delta

Sell 1 AAPL Jan 15, 2020 115 Put @ 1.76

Buy 1 AAPL Jan 15, 2020 105 Put @ 0.57

Max Profit: $119

Capital At Risk: $881

Return Potential: 13.51%

With this example, we’re risking only $881 for a potential return of $119 which equates to a 13.51% return on capital.

Adding the long put also adds a bit of a hedge against a move lower in the stock.

After opening the position, the trader receives a credit of $119 into their account, hence the term credit spread.

With a credit spread, the trader either wants the entire position to expire worthless, leaving them with a gain equal to the credit received, or they want the price of the credit spread to drop, allowing them to buy it back for less.

We’ll look at specific trading rules shortly.

Looking at the payoff graph, the interim line (purple line), we can see that a 10% drop in the stock price results in a loss of around $490 for the naked put but only $280 for the credit spread.

That’s before any increase in implied volatility which tends to happen when a stock drops.

You can see that credit spreads are a much better way to utilize capital particular for small account holders.

3 Types Of Credit Spreads

So far we’ve looked at the first and easiest to understand credit spread which is the bull put spread.

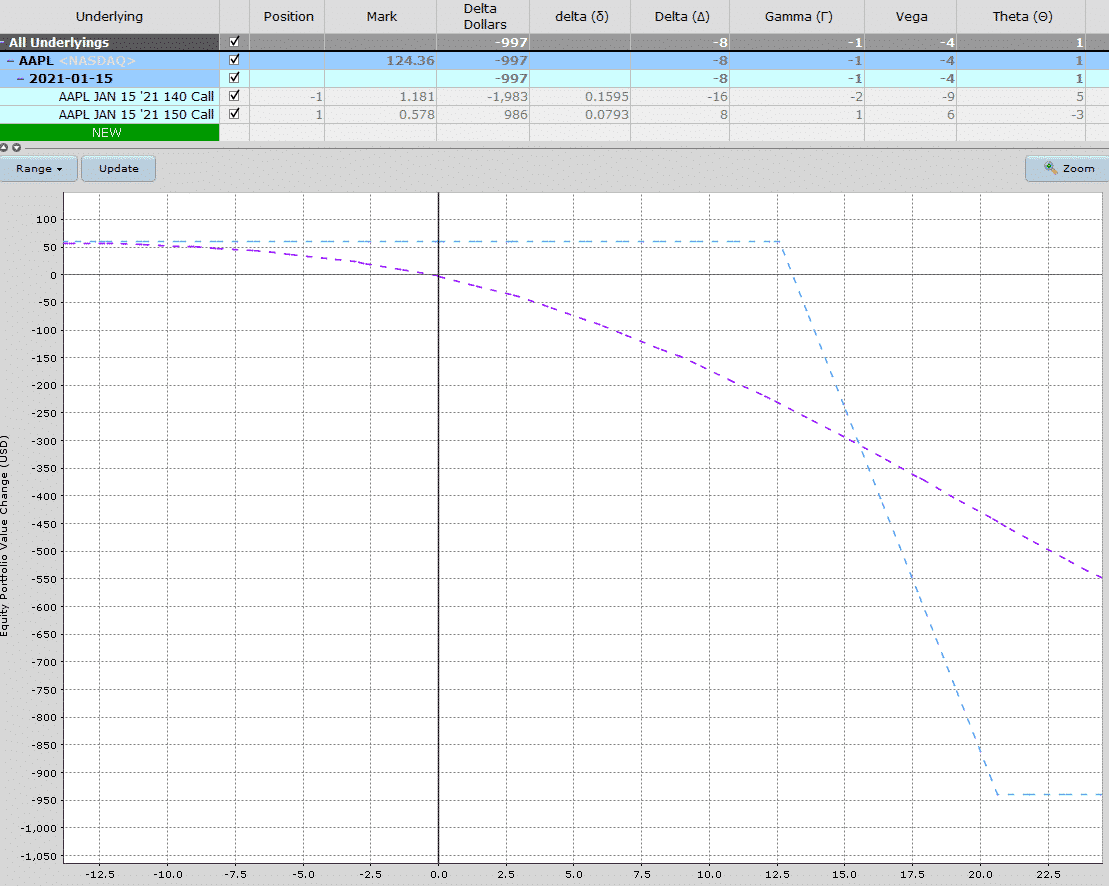

The opposite trade is a bear call spread.

A bear call credit spread is created by selling an out-of-the-money call and buying a further out-of-the-money call.

Like a bull put spread, it is a risk defined strategy with a healthy return on capital potential.

Let’s look at an example using AAPL again.

Date: December 8th, 2020

Underlying Price: 124.30

Strategy: Bear Call Credit Spread at 15 Delta

Sell 1 AAPL Jan 15, 2020 140 Call @ 1.18

Buy 1 AAPL Jan 15, 2020 150 Call @ 0.58

Max Profit: $60

Capital At Risk: $940

Return Potential: 6.38%

With this bear call credit spread, the trade is risking $940 for a potential return of $60 or 6.38%.

This example if using a 15 delta because there was only a choice of 23 delta or 15 delta.

Going further out in price results in a lower credit and therefore lower return potential.

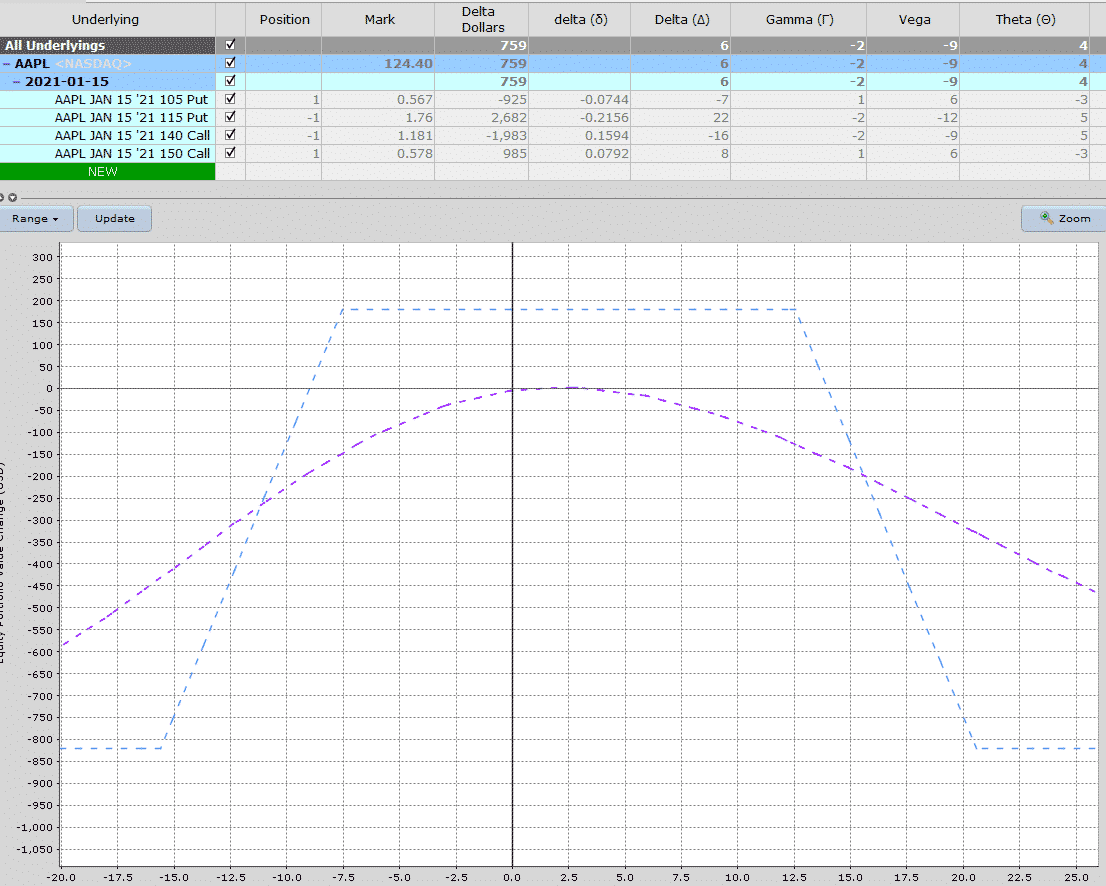

Combining 2 Credit Spreads To Create An Iron Condor

An iron condor is a popular trade for traders looking to trade for a living and is simply a combination of the two credit spreads that we’ve already looked at.

Here are the details:

Date: December 8th, 2020

Underlying Price: 124.30

Strategy: Bull Put Credit Spread at 20 Delta

Sell 1 AAPL Jan 15, 2020 115 Put @ 1.76

Buy 1 AAPL Jan 15, 2020 105 Put @ 0.57

Sell 1 AAPL Jan 15, 2020 140 Call @ 1.18

Buy 1 AAPL Jan 15, 2020 150 Call @ 0.58

Max Profit: $179

Capital At Risk: $821

Return Potential: 21.80%

By combining the two credit spreads we’ve generated two lots of premium and slightly reduced the capital at risk.

The iron condor is risking $821 for a potential return of $179 or 21.80%.

Note that the condor in this example is slightly skewed because the short put is closer to the stock price than the short call.

This gives the trade a slight bullish bias.

How To Start Trading Credit Spreads For A Living

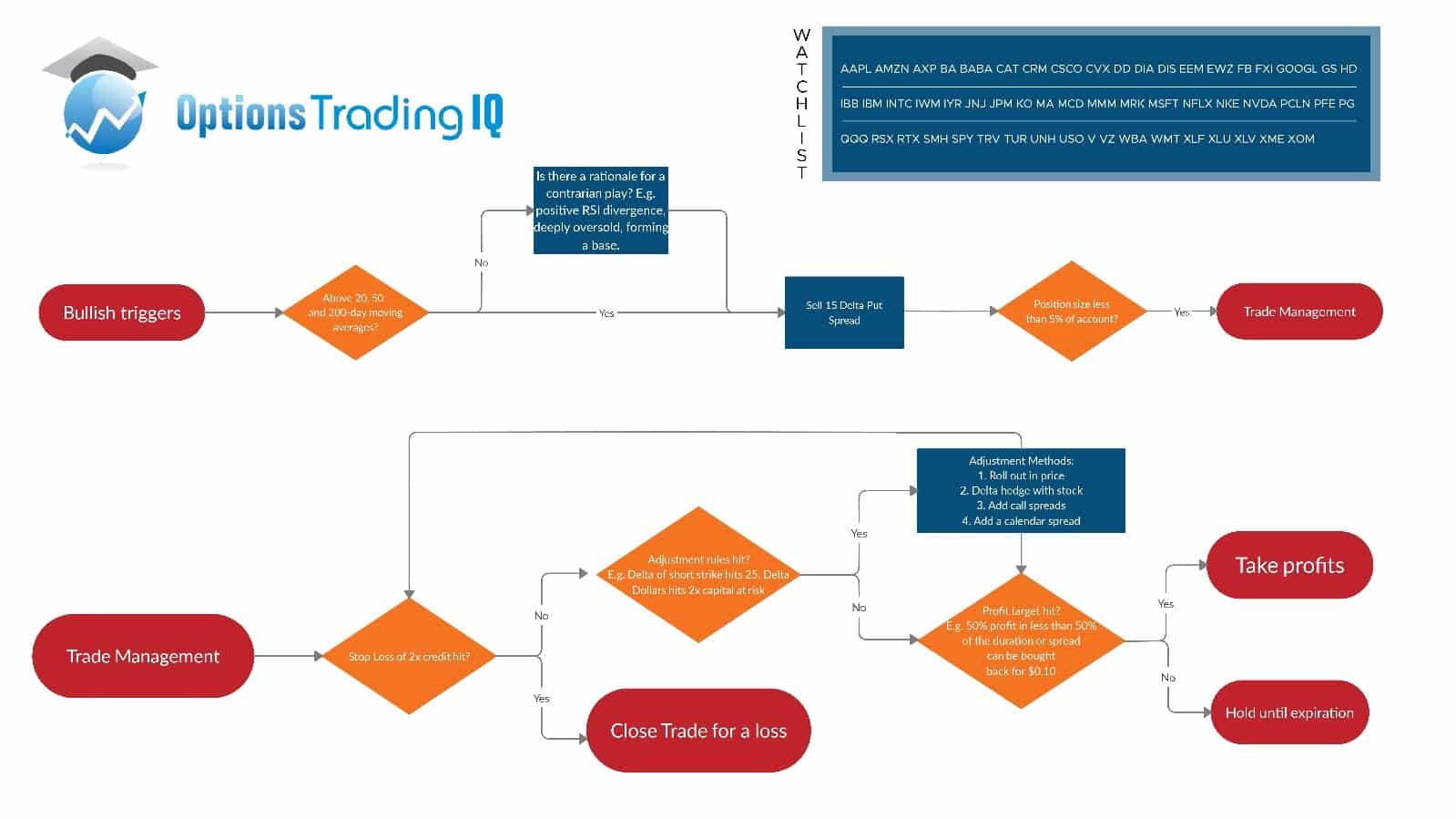

A simple method for trading credit spreads for a living is to start with bull put spreads as they are the easiest to understand.

I find the key is to be really mechanical with the decision-making process and take emotion out of the equation.

Here is a good process to get you started:

- Find a bullish stock – Criteria could include the stock being above the 50-day moving average

- Sell a bull put credit spread with short strike at 15-20 delta

Placing the trade is the easy part, managing the open trade is the hard part. Here are some rules to consider:

- Set a stop loss of 1.5x – 2x the credit received.

- Take profits if 50% of the income potential has been achieved in less than 50% of the time.

- Adjust if delta of the short strike hits 25-30.

- Otherwise hold to expiry

Below is a visual representation of the trading plan for bull put credit spreads. You this link to see a bigger version.

The plan below also includes a watchlist of the best stocks for credit spreads.

With the information in this article, you are well on your way to trading credit spreads for a living.

One final thing to not is position sizing. When starting out, traders should paper trade first for a few months and then start risking only small amounts of capital per trade – no more than 5% of total account size.

Also, consider using Option Net Explorer to run through some back tests which will give you a really good feel for credit spreads.

One key to successful credit spread trading is having effective trade management and adjustment strategies when the trade moves against you.

This guide details a few different adjustment strategies that can be used to turn a losing trade into a winner.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thanks Gav. In your example (put credit spread) I also like to consider contrarian overbought indicators if the stock is meeting your trend criteria so that I’m not getting in the way of a possible trend change. Cheers.

Hi Gav. I’m a relative newbie and so far trade covered calls & secured puts (100% un-leveraged), can you explain something on the credit spreads? I completely understand limiting the capital at risk via credit spreads, however I’m not sure I get why you get to use “capital at risk” as the denominator in return calculations instead of capital tied up in the trade. Correct me if I’m wrong, but any broker I’ve used will reduce your buying power by the amount tied up in the short put less premiums, even when employing a credit spread. IMHO, it’s of course accurate to say you’ve substantially reduced your risk with the credit spread, but I think it is a bit misleading to present the return as being so much greater. In the example above, the actual return on the Bull Put Credit Spread would be about 1.05% (vs. the 1.55% on the cash secured put) in my way of thinking. Which makes A LOT more sense, right? You’ve reduced risk so potential returns will generally decrease as well, not increase. BTW, I’m not trying to single you out, saying you’re being dishonest or anything lol, I think most everyone I’ve seen in the options world calculates it that way. I’m just hoping you have an explanation as to why that makes sense to do. Your capital is still locked up in that trade, so why wouldn’t it count in the rate of return?

Hi Cory, I respectfully disagree. The most you can lose and the capital tied up in a credit spread is the difference in the strikes less the premium received. Which broker are you using? If your broker is reducing you buying power by the entire short put, then you need to find a new broker!

Haha! Thanks for the reply, Gav. I’m using TD Ameritrade. I’ll ask them directly what the deal is, but when I enter a credit spread, the order confirmation page definitely shows a reduction in buying power of the entire short put (minus premium, of course). And when I placed the order it did indeed reduce my buying power by that amount. HOWEVER, I’m so glad to hear that maybe that shouldn’t be the case though. It always seemed strange to me but I just thought well, that’s the rules! lol. I feel like I remember this was the case with Scottrade too several years ago, IDK. Thanks again.

No worries. Definitely contact them and let me know how you get on. Otherwise switch to Interactive Brokers.