In the last lesson, we learned about the collar trade, this week we are going to look at a variation on the collar trade.

View previous covered call lessons on covered calls 101, compounding, volatility, open interest, selecting covered call strikes, setting up a covered call portfolio, when to sell covered calls, how to limit losses on covered calls, and the Dogs of the Dow plus 2015 Update.

Covered calls have very similar downside risk to stock ownership. The premium received for selling the call only provides minimal protection in the event of a major down move. Those that are concerned about a stock suffering a big loss can buy a put option and turn the trade into a collar.

The problem with regular collar trades is that the long put experiences rapid time decay.

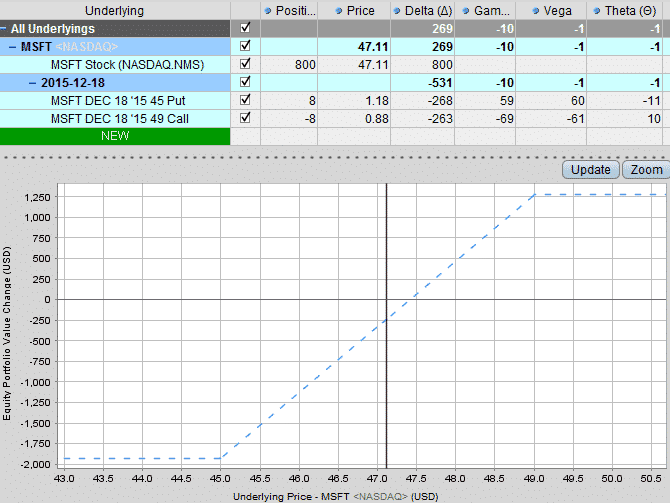

Looking at an example on MSFT with the stock trading at $47.11 in early October 2015.

Setting up a collar trade using December $49 calls and $45 puts, actually results in negative Theta, which means the position is losing money as time passes. This is not what you want to see as an options income trader. The puts, at $1.18 cost more than the calls at $0.88 despite them being a similar distance from the stock price. The reason for this is the implied volatility skew, with traders willing to pay more for downside protection.

In order to structure the trade with positive Theta, the trader could buy a longer term put which experiences less time decay.

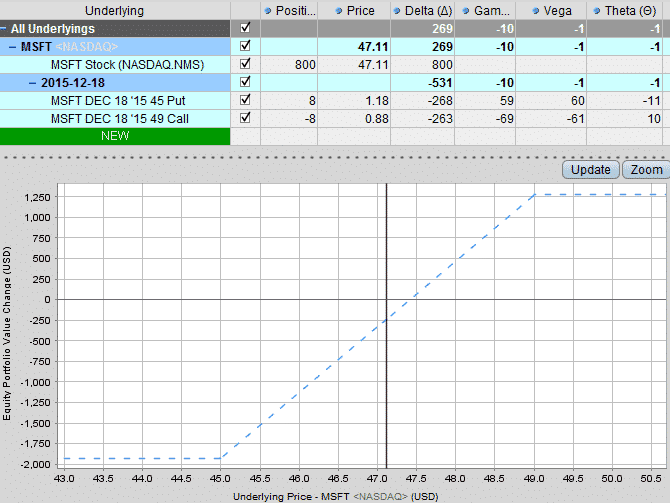

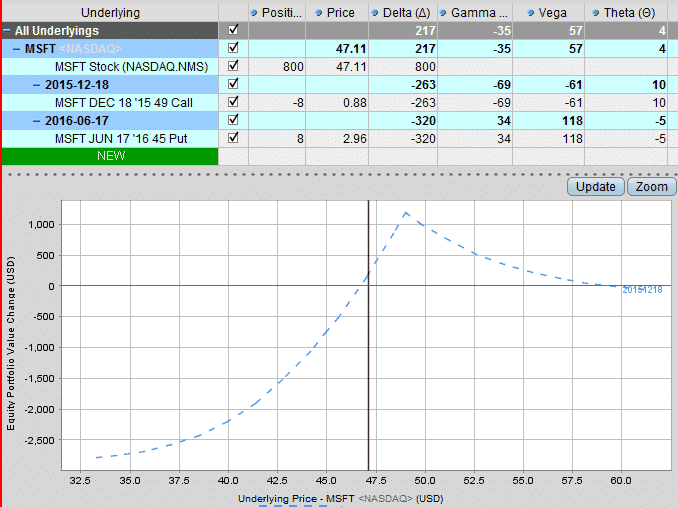

Instead of buying the shorter-term December put, this next example looks at a June 2016 put with the same strike. This option costs a bit more, but notice that the Theta on the put is -5 as opposed to -11.

This results in a combined Theta of +4 for the total position. All things being equal, the second trade should generate more gains from time decay each day.

The trader with the longer term put could roll the option out every few months so that they never had to suffer from the sharp time decay that occurs in the last 1/3 of the puts life.

Another advantage of the June put is the total position has positive Vega. As such, the second position has the potential to provide more protection in the event of a selloff if implied volatility rises sharply.

You have probably noticed the difference in the shape of the payoff diagram, this is something that the trader would need to consider. If MSFT made large gains, the longer term put would lose more value than the shorter term put.

What do you think about the idea of using longer term puts to protect covered calls? Let me know if the comments section below.

I do this, and then I sell a lower strike, shorter term put against my longer term put if/when price trades down to where the longer term put is to help finance the cost of the protection. I use a

support level below for the short put.

Nice idea Jim, thanks for sharing this strategy with my readers.

Dear,

thanks for your educational mailing.

Q1: whats your exact triggerpoint for writing calls.

Q2 : whats you triggerpoint for buying puts? here you can say the cost of putbuying is reduced by call selling.

Q3 : do you make any differentiation for buying puts “pre earnings” versus “potentional ” bear market.

Kind regards,

Jos

Hi Jos,

1) I like to stick to stocks in defined uptrends. I want to see higher highs and higher lows, also stocks that are trading above the 20 day moving average.

2) No trigger point for the puts, I make a judgement call on when I might need some protection.

3) Puts can be very expensive pre-earnings, so I try not to trade around earnings and instead focus on the longer-term process. If I see a potential bear market developing, I would not be trading covered calls.

Thanks for your comment.

Thanks Gavin, I have one query. 20 day moving average is very short term and even good quality stocks go bellow it during correction. So what do you do with such stock you were earlier writing covered call? Use stop loss 8% %

Yes exactly. Otherwise if something else on the chart told me the situation had changed. It’s ok to be wrong, it’s not ok to stay wrong.

v. good