A bear call spread involves selling an out-of-the-money call and buying a further out-of-the-money call.

The strategy can be profitable if the stock trades lower, sideways and even if it trades slightly higher, as long as it stays below the short call at expiry.

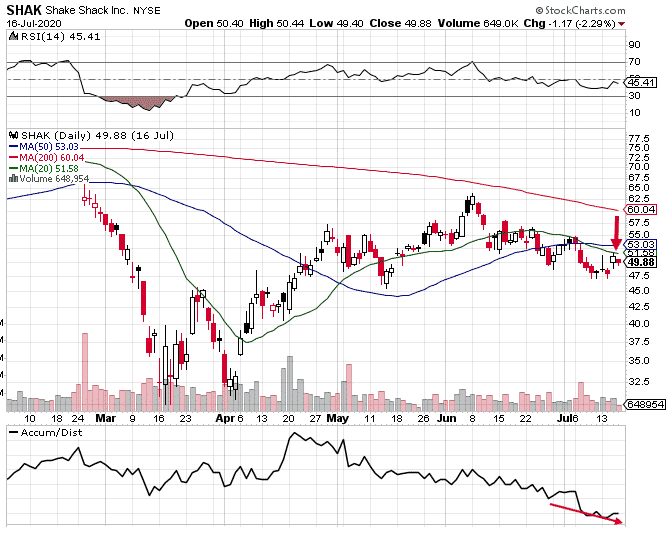

Today I want to share a recent example of a bear call spread on SHAK that was opened on July 16th.

At the time SHAK was trading at 49.88 and the thesis for the trade was that the stock was hitting resistance at the 20-day moving average and was showing distribution from a money flow perspective.

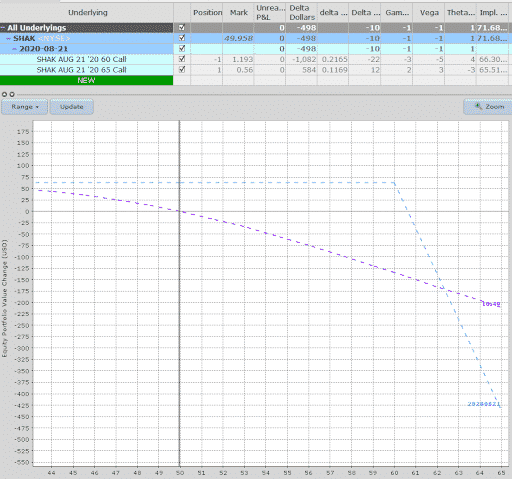

The trade details were as follows, I’ll use 1 contract in this example to keep it simple.

Date: July 16, 2020

Current Price: $49.88

Trade Set Up:

Sell 1 SHAK August 21, 60 call @ $1.19

Buy 1 SHAK August 21, 65 call @ $0.56

Premium: $63 Net Credit

Capital at Risk: $437

Return Potential: 14.41%

For this trade I set a stop loss of two times the premium received and / or if the stock broke above $54.

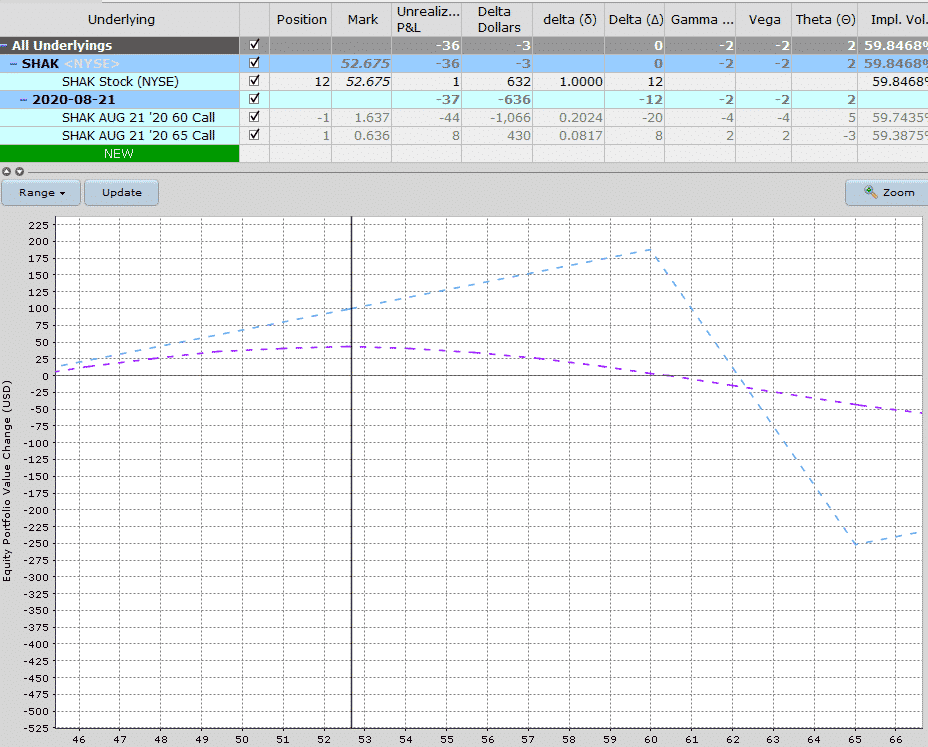

On July 30th, SHAK was trading at $52.67 and the trade was down $36 per contract. As it was close to the stop loss, I decided to delta hedge.

At the time, the trade had a delta of -12 per contract. Buying 12 shares neutralized the delta, allows me to stay in the trade longer and even increases the profit potential on the upside.

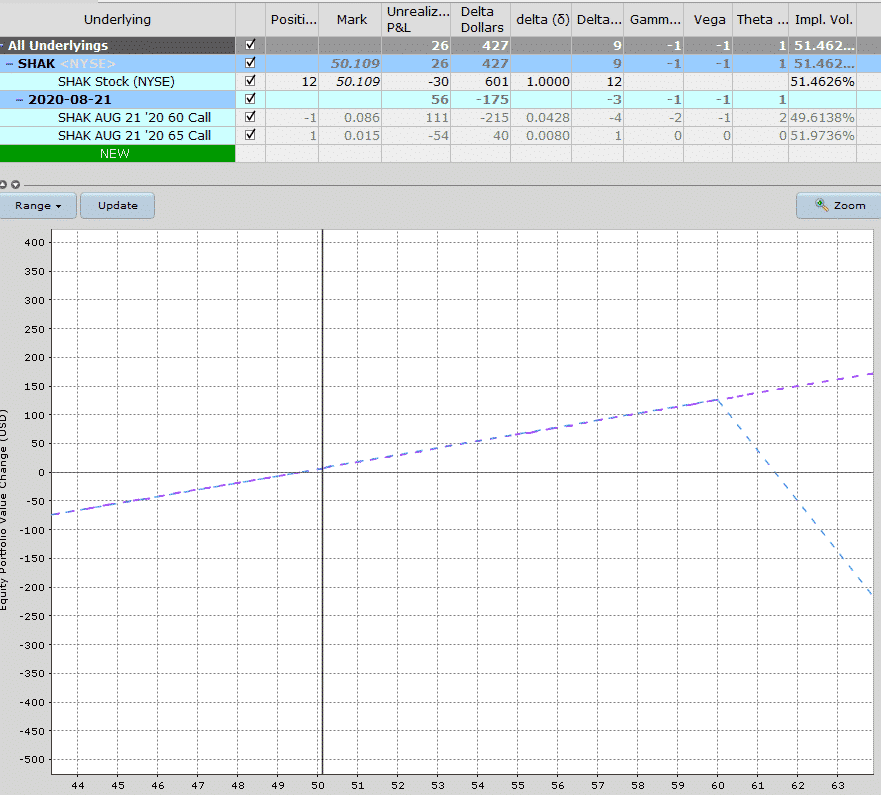

By August 6th, SHAK had dropped back down to 50.11 resulting in the bear call spread moving from -$36 to +$56.

I lost money on the hedge, but it allowed me to stay in the trade and turn a losing trade into a winning trade.

The overall profit was $26 per contract or around 5.95% on capital at risk.

I hope you enjoyed this example, it you have any questions, let me know.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Sir,

please write blog on option chain analysis on advanced level.

This might help you – https://optionstradingiq.com/what-is-open-interest-in-options/

Sir, why is stop loss at 54? Please explain. Thanks.

If it broke above 54, then it would be above both the 20 and 50-day moving averages so that was the level I set. Also looking at the T+0 line, 54 was around the level where the loss on the trade would be 2x the premium received.