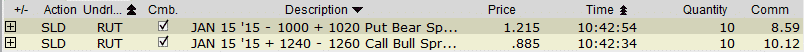

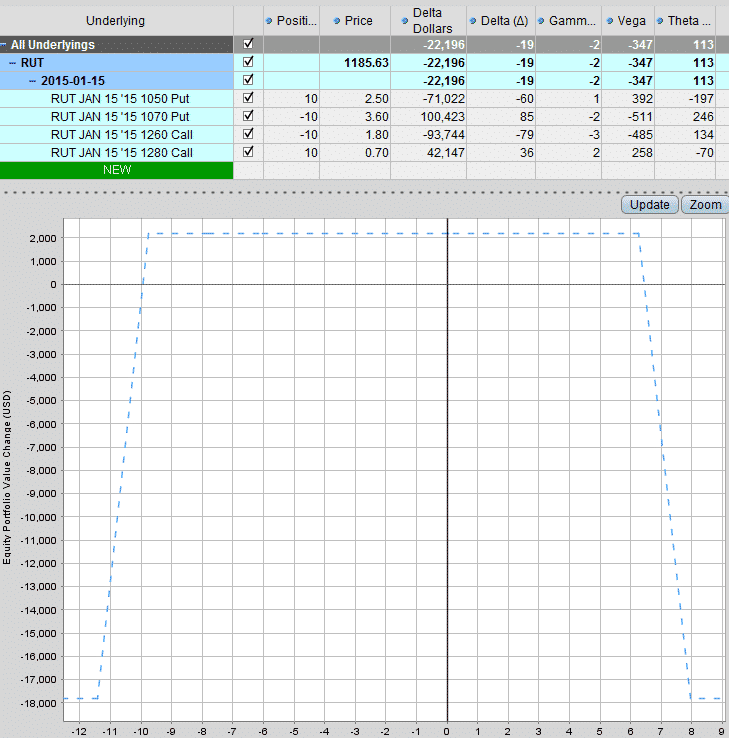

December 17th 2014 – RUT Iron Condor – Opening Trade:

Volatility has spiked nicely over the last week and it’s a great time to start looking at short volatility trades such as an iron condor. With the Fed meeting this afternoon, I would expect volatility to drop in the afternoon. RVX is currently at 25.50 which is close to the highest we have seen this year.

The following trade is using the same strikes as our Trapdoor but that’s ok, we will manage the positions separately. Will adjust if the delta dollar exposure hits $60,000 or if the delta of the short strikes hit 25.

Total return potential is around $2,000 on $18,000 capital at risk for a roughly 11% return.

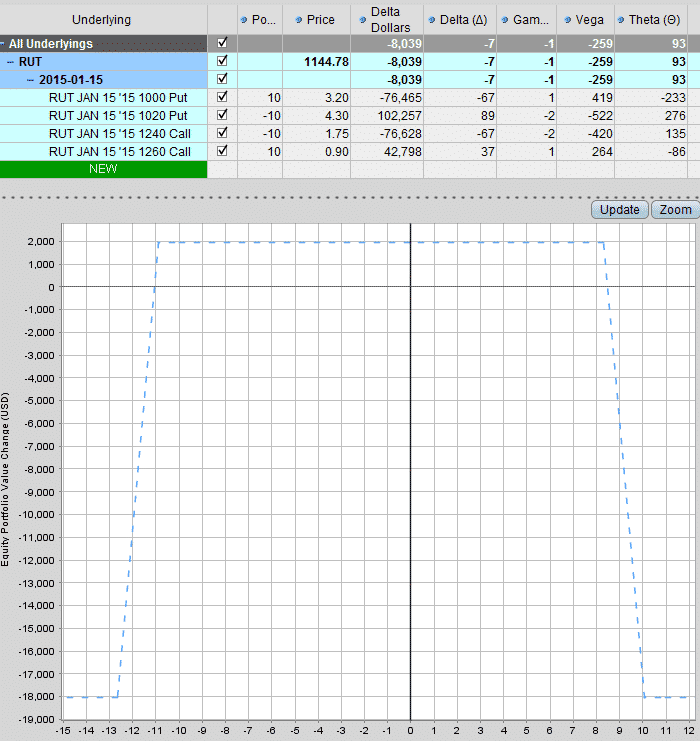

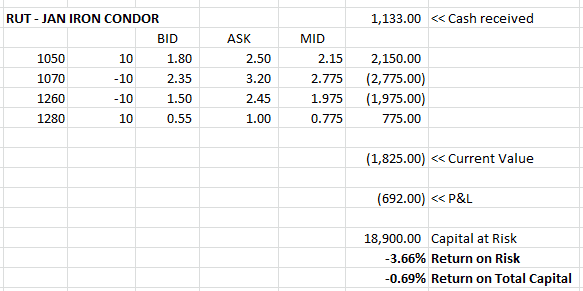

December 18th 2014 – RUT Iron Condor – Adjustment:

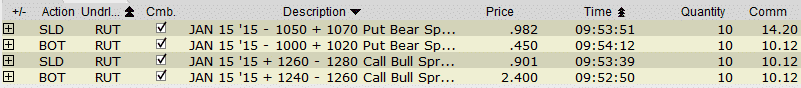

Nothing like a Fed fuelled 4% rally to throw a spanner in the works for an iron condor. Rather than take on too much directional exposure and risk getting burnt on this thing, I’m repositioning the entire condor to get it back closer to neutral.

Rolling the puts up to 1070-1050 and the calls to 1260-1280

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

December 18th 2014 – RUT Iron Condor – Weekend Update:

We’ve taken a little bit of heat so far on our condor with the market making a huge move up. So far we’re down $600 and our adjustment has reduced our profit potential.

We will need to be careful of a strong rally from here.

The greeks are looking ok heading in to the weekend.

December 24th 2014 – RUT Iron Condor – Closing Trades:

Unfortunately we’ve been fighting this condor a bit since day 1 and I don’t think it’s wise to continue holding it given we are in the midst of a Santa Claus rally.

A sharp rally on any day would see this trade seriously under water, so the risks are just not worth it.

![]()

TOTAL P&L: -$445