FANG stocks (FB, AMZN, NFLX, GOOGL) have lost their bite since the election, but they may be getting ready to bounce back. FB has been particularly hard hit due to issues surrounding fake news items showing up in users news feeds.

Some users also reported a bug on November 11th when Facebook accidentally announced the deaths of people who logged into their accounts. Yikes. Embarrassing!

Following the election there has also been strong rotation out of tech stocks, but some observers think trade might be overdone.

Since October 24th, Facebook stock is down over 13%. Will this trend continue or is this a buying opportunity?

I tend to fall in to the mean reversion camp and try to be greedy when others are fearful. There is a lot of negativity around Facebook currently and I see that as a buying opportunity.

We are 100% in the midst of a great technological revolution, not dissimilar to the industrial revolution of the late 1700’s and early 1800’s.

The pace of change in the tech industry is phenomenal with many industries being fundamentally and permanently disrupted. Facebook is a leader in the tech space and should continue to be at the forefront of technological advancement.

Purely based on the number of ads appearing on Facebook these days, you have to assume Facebook’s revenue will continue to grow. The ability to create target audiences for ads is far above what can be done on other platforms.

While there may be some further short term pain for Facebook shareholders, the stock is a good long-term buy.

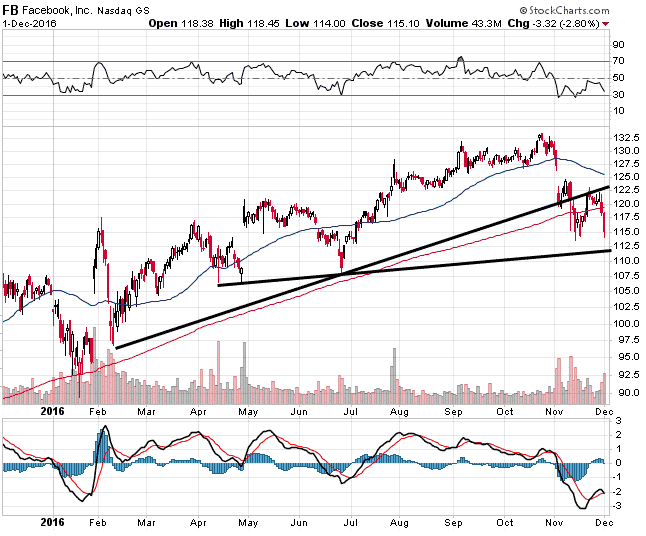

Looking at the technical picture, the major concern is the break of the 200 day moving average. Bad things can happen to stocks below that level and some big players will avoid stocks below the 200. Therefore, it might make sense to wait until the 200 is recaptured before jumping in.

Price was recently rejected at the prior trendline, however there is strong support around $112.

MACD looks bearish.

All in all, the technical picture is not great. However, if you are willing to be patient, take a contrarian view and have a long-term horizon, you may get a good opportunity to buy some FB for a discounted rate.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi Gavin,

Nice article. It got me thinking that maybe this is a good time to consider selling some naked puts in FB chiefly because:

A. Due to the current oversold nature of FB the risk/reward is in your favour

B. Should the price drop further then you have the opportunity of picking up a market leader at a potentially bargain price.

Right now you should be able to pick up FB Jan 20 100 puts for about 0.60. That is 13% away from the current price levels (a good cushion)

Of course you should only sell the number of put contracts that equate to the amount of stock in FB you would like to hold in your portfolio should the puts expire in the money.

Hi Andy,

I agree, although I would like to see FB drop a little further before selling puts. The technical picture is concerning.

Another strategy would be to buy some LEAP call options and then sell monthly calls against those.

Gav.

I think you’all be able to buy FB at under $100 by January just in time for the $6B buyback. Frankly, I think management has anticipated this 25% haircut from the $133.91 alltime AHs high in Q2. Andrew Left got it right (that pric!).