While calendar spreads can be done with monthly options, more and more investors are trading calendar spreads with weekly options.

We will look at some of these reasons in this article.

Contents

- Monthly Calendar Spread

- Weekly Options For Calendars

- Vega To Theta Ratio

- Reward-To-Risk

- SPX Calendars

- FAQs

- What Is The Ideal Vega To Theta Ratio?

- Conclusion

Monthly Calendar Spread

To understand why weekly options give the investor greater flexibility, we will first look at the limitations of monthly options.

We will do an example in OptionNet Explorer of a monthly calendar spread where we sell the next available monthly option and buy another option the next month out.

This will be an at-the-money calendar, so both options will have the same strikes near the current price.

Suppose we want to place a calendar on the stock Travelers Company (TRV).

Since it does not have options with weekly expirations, we will use the next available monthly expiration, such as:

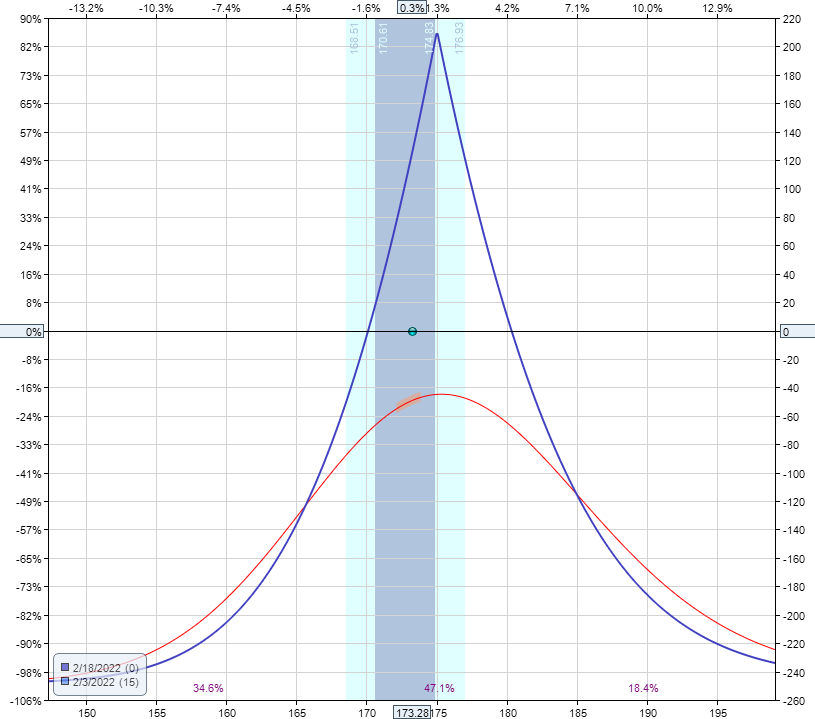

Date: February 3, 2022

Price: TRV @ $173.28

Sell one Feb 22 TRV $175 put @ $4.05

Buy one March 18 TRV $175 put @ $6.50

Total cost: $245

Delta: 4.08

Vega: 9.88

Theta: 4.18

Gamma: -1.94

The risk to reward on this calendar is not great. We are risking $245 to have a maximum potential profit of $210.

The short option in this calendar expires in 15 days.

This short duration means you have to monitor the calendar intraday because a significant price movement can cause a large loss in the P&L (profit and loss).

Note the value of delta is at four and a large value of gamma at nearly 2.

The alternative is to use the next monthly expirations out.

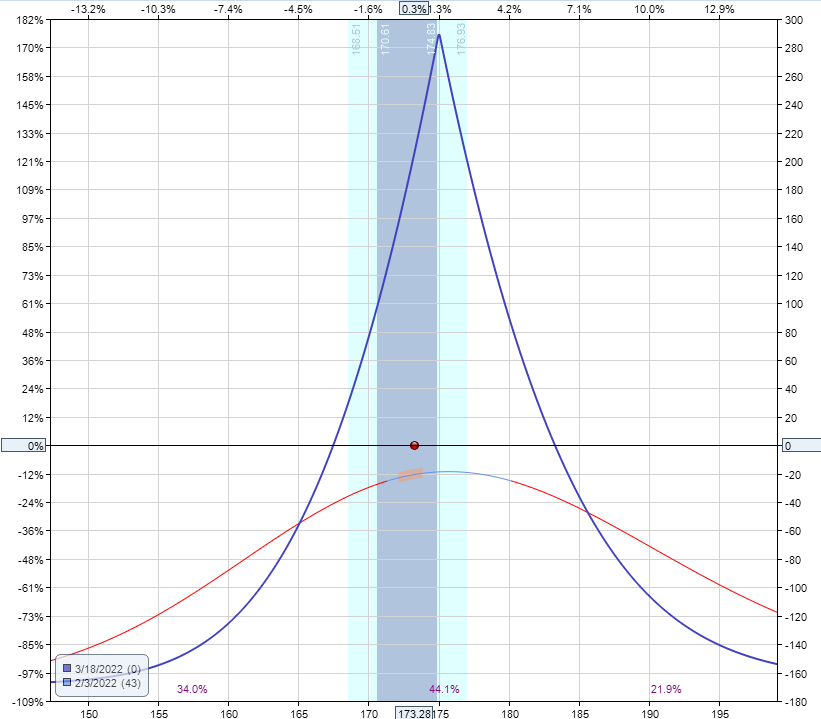

Trade Details:

Date: February 3, 2022

Price: TRV @ $173.28

Sell one March 18 TRV $175 put @ $6.50

Buy one April 14 TRV $175 put @ $8.15

Total cost: $165

Delta: 1.66

Vega: 6.61

Theta: 1.21

Gamma: -0.68

The short option is now 43 days to expiration.

This one has a much better reward-to-risk ratio of 1.75 = $290/$165.

Because of its further expirations, the delta is smaller and, more importantly, a much smaller gamma of less than one.

One drawback is that now theta has become small.

So small that vega is more than five times theta.

In the previous calendar, vega is only 2.4 times larger than theta.

This large vega compared to theta means that this longer-dated calendar has greater volatility risk.

It can get hurt more if volatility goes down.

Calendars prefer when volatility goes up.

Weekly Options For Calendars

In order to get something in between these two extremes, perhaps something with the short strike at 30 days to expiration, we have to look to a stock that has weekly options.

Apple (AAPL) is one such stock with a similar price range.

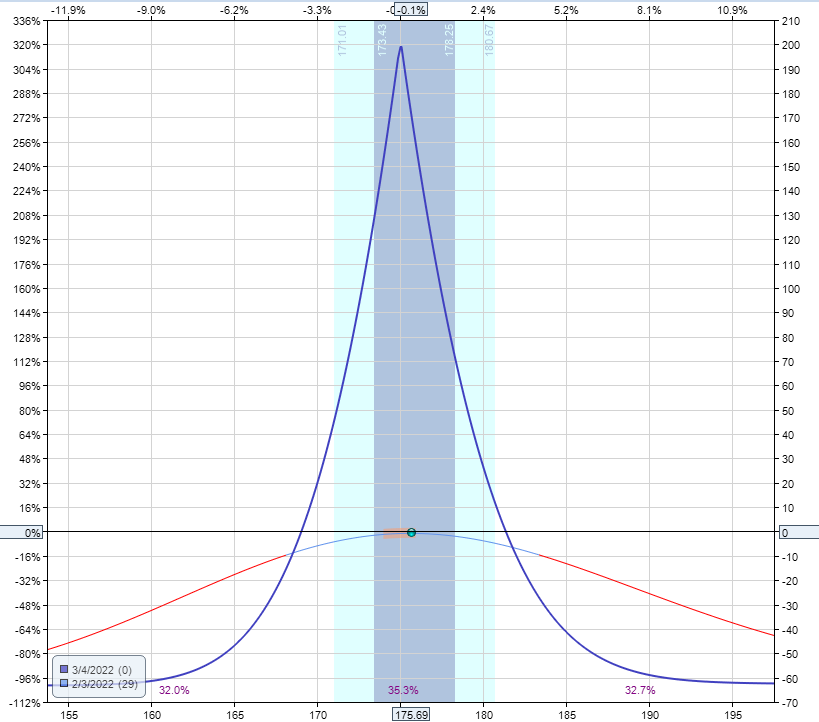

Date: February 3, 2022

Price: AAPL @ $175.69

Sell one March 4 AAPL $175 put @ $5.00

Buy one March 11 AAPL $175 put @5.63

Total cost: $63

Delta: -0.04

Vega: 2.25

Theta: 0.86

Gamma: -0.33

We sold the short option at 30 days to expiration.

And we bought the long option with an expiration of 7 days beyond that.

With the availability of weekly options, we can have the long-dated expiration only one week after the short-dated expiration.

By making these two option expirations closer together, we decrease the cost of the calendar.

Hence, it has a higher reward-to-risk ratio of 3.2 = $200/$63.

For calendars, the max risk is the cost of the calendar.

Note that this butterfly only costs $63 for one contract, even though TRV and AAPL both have a stock price of $175.

Now you can scale up with more contracts on AAPL.

With the two option expirations being close together, it also decreases vega.

The vega is only 2.6 times larger than theta, which is good.

It is not five times larger as in the previous example.

Vega To Theta Ratio

A lower vega to theta ratio means the calendar is less sensitive to volatility changes.

This is a good thing if you don’t want to have P&L hurt if volatility goes against us.

However, some may want greater exposure to volatility changes if implied volatility

(IV) is currently very low and expect volatility to increase and benefit the calendar.

In that case, increase the time between the two expirations.

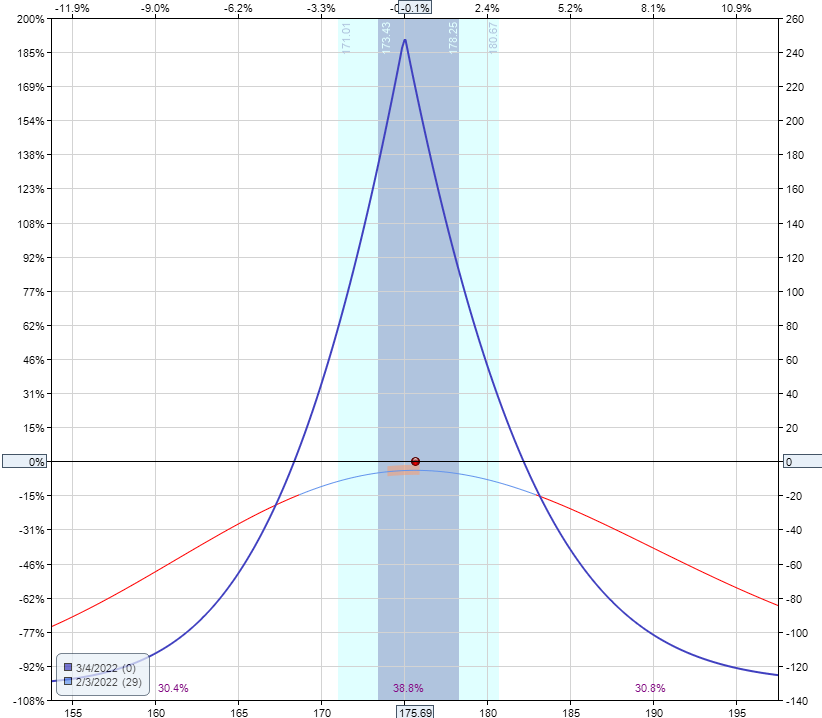

For example, you can do the following:

Date: February 3, 2022

Price: AAPL @ $175.69

Sell one March 4 AAPL $175 put @ $5.00

Buy one March 18 AAPL $175 put @6.30

Total cost: $130

Delta: -0.04

Vega: 4.28

Theta: 1.43

Gamma: -0.6

This doubles the cost of the calendar, and it increases the vega exposure to a vega/theta ratio of 3.

Reward-To-Risk

The reward-to-risk of this new calendar decreased to $245/$130 = 1.9.

A closer examination of the payoff graph shows that this new calendar is also slightly wider.

Note where the expiration graph crosses the zero P&L horizontal.

Having weekly options allows us to adjust our calendars to be either tall and narrow or shorter and wider.

Tall narrow calendars give us a higher reward-to-risk ratio.

Shorter and wider calendars give us a greater range in the expiration breakevens.

SPX Calendars

If you trade calendars on the indices like SPX, you can bring the expirations even closer together.

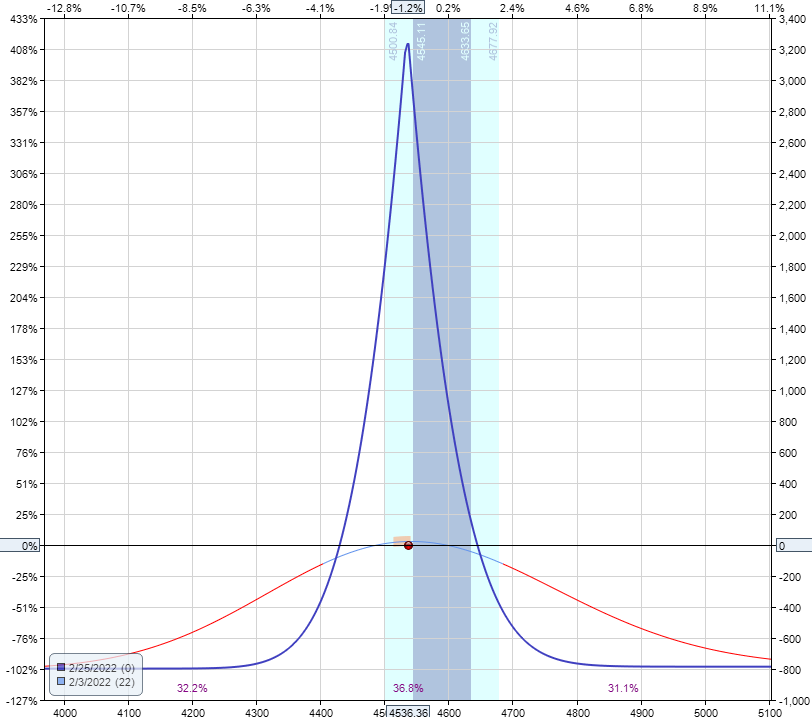

Here is an SPX calendar that is only five days apart in expirations:

Date: February 3, 2022

Price: SPX @ 4536

Sell one Feb 25 SPX 4535 put @ $86.20

Buy one Mar 2 SPX 4535 put @ $94.05

Total cost: $785

Delta: 0.08

Vega: 47.83

Theta: 20.92

Gamma: -0.01

Reward-to-Risk: 4

Vega/Theta ratio: 2.3

With the larger availability of option expirations on the indices, you can even have expirations that are even close together.

But don’t overdo it by making your calendar too narrow.

Narrow calendars must be monitored closely because any significant move in price will put the price outside of the expiration graph.

This means you have to adjust more quickly, and there is a greater price risk.

FAQs

Is it better to use calls or puts for the calendars?

It makes no difference whether you use two call options or two put options for at-the-money calendars that we are discussing in this article.

For directional calendars, it is better to keep the options out-of-the-money.

So, for a bearish calendar use puts and for a bullish calendar, use calls.

Is it better to use calendars in low or high IV?

Because calendars are long vega, they benefit if volatility increases.

So, they are generally placed when IV is low, expecting IV to increase back to its mean.

How does a calendar make money?

An at-the-money calendar makes money through theta decay as long as the underlying price does not move too much.

The option that we are selling has a shorter-dated expiration.

Its value will decay faster than the option that we are buying.

This is good because when we sell something, we want that something to lose value.

The option that we are buying has a longer-dated expiration and decays slower.

This is good because the thing we bought will keep its value better.

Basically, the calendar makes money because the option we are selling will decay in value faster than the option we buy.

What is the ideal Vega to Theta ratio?

Vega should be no more than five times larger than theta.

That means you want a vega/theta ratio to be less than 5.

This is the same as saying that you want the theta/vega ratio to be greater than 0.20, which is what this Tastytrade video says it uses as its benchmark.

Conclusion

The availability of weekly options is a boon to calendar traders because it enables them to adjust the shape of the calendar to provide them with the Greeks they want.

If they were limited to only monthly options expirations, the difference in expirations between the short and long options would be at least one month apart.

Since the time difference between the two options is rather significant, the implied volatility of the two options can change independently and in unpredictable ways.

To avoid exposure to random volatility changes, some calendar traders prefer to have the short-dated expiration close to the long-dated expiration — perhaps only one week apart or even five days apart.

And this is only possible with the use of weekly options.

We hope you enjoyed this article on calendar spreads with weekly options.

If you have any questions, please send an email or leave a comment below

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.