Read Part 1 – The Basics

Read Part 2 – How To Set Profit Targets and Stop Losses

Read Part 3 – How To Successfully Leg Into A Butterfly

Read Part 4 – Trading Rules

Read Part 5 – Using Low Risk Directional Butterflies

Read Part 6 – The Greeks

Read Part 7 – Broken Wing Butterflies – One-Size Fits All

Read Part 8 – The Reverse Butterfly

Read Part 9 – Using Butterflies In A Combination Or As A Hedge

Today we’re looking at how to protect your butterfly trades against fast moves in the stock.

How often does it happen where you put on a trade and then within hours, sometime even minutes, the stock goes on an absolute tear and leaves you sitting on large losses? It happens all the time and it’s really annoying!

With butterflies, there is a way to give you a little bit of protection against this.

Let’s say you put on a standard neutral butterfly but are concerned that the market might rocket higher. Adding an extra call can give you a great deal of protection against this without adding much more risk on the downside.

Let’s look at an example:

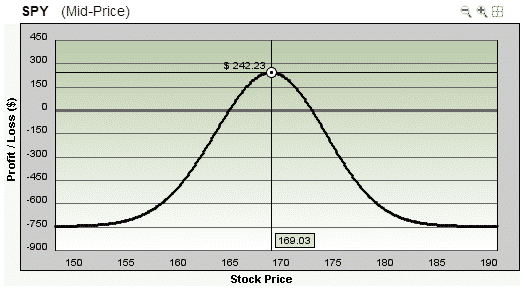

Date: August 5th 2013,

Current Price: $170.70

Trade Details: SPY Neutral Butterfly

Buy 5 SPY Sept 20th $165 calls @ $6.80

Sell 10 SPY Sept 20th $170 calls @ $3.05

Buy 5 SPY Sept 20th $175 calls @ $0.80

Premium: $745 Net Debit

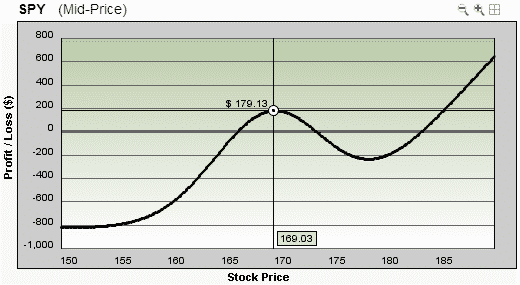

Now we’ll add the extra call.

Trade Details: SPY Neutral Butterfly

Buy 1 SPY Sept 20th $175 calls @ $0.80

Premium: $825 Total Net Debit

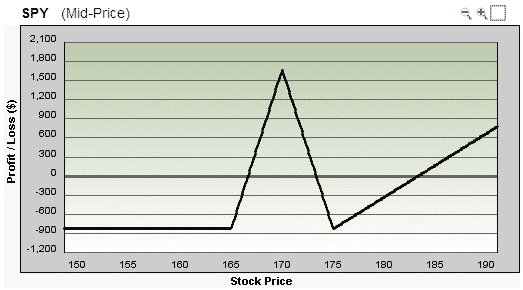

Looking at the payoff diagram at expiry you might not immediately see the benefit of this variation as the stock would have to move a long way to the upside in order to reach a profit. However, the main benefit comes if the stock makes a fast move early on in the trade.

Let’s assume that SPY continues to rocket higher and climbs 5% in the next three weeks to around $180. At this level, the standard butterfly would be showing losses of $650 which is nearly a complete wipe out.

The extra call variation will be showing losses of around $220 which is significantly lower than the standard butterfly, and all it cost you was an extra $80.

What do you think of this variation? Let me know in the comments section below.

why should trade use butterfly if he/she know that the stock or SPY index goes higher or up trend in the first place. It maybe better to play straddle or strangle?

Potentially yes. Long straddles and strangles suffer a lot of Theta decay.

if the stock goes down trend, then we need to buy additional PUT option and we need to pay another premium, then three trades incurred more cost and losses.

That is true, it costs more. Most hedges will either cost money or increase capital at risk. There’s no free lunch unfortunately.

Great article.

When price moves up significantly in short time, we can’t buy the extra otm call at 0.8 as shown in example. It will be much costlier , I believe.

Yes, you want to do it before the move occurs, not after.

It’s worth buying the CALL (or PUT if the direction is opposite) even if it’s dramatically more expensive. This stops the large loss on an upward move. Even if it’s bought after the break of the break evens.

Yes that can work. It does leave you exposed on the other side though.