There are many ways to trade earnings with options but in my opinion the best pre earnings option strategy is the diagonal call spread.

Earnings are when a publicly traded company announces their financial results for a set period of time. In the United States, this occurs every quarter and it is always a busy time in the market and a great time for looking at option trades.

Previously, we’ve looked at buying pre earnings straddles, but today I want to share another of my favorite pre earnings option strategies.

I’ll explain what the trade is, how it works, what can go wrong and what to look out for. We’ll also go through some past examples.

Enjoy!

Contents

- Earnings And The Impact Of Implied Volatility

- My Favorite Pre Earnings Strategy

- Trade Management

- Conclusion

Earnings And The Impact Of Implied Volatility

It’s been well documented that implied volatility tends to remain elevated in the lead up to an earnings announcement and then gets crushed afterwards.

Therefore, there are opportunities available to option traders to benefit from this phenomenon.

Earnings releases are binary events. They can either have a positive or a negative outcome. Personally, I like to trade pre earnings and not take any exposure over the actual earnings event.

I’ve seen too many time when a stock’s move after earnings is well in excess of the expected move.

The risks of trading a binary event like this are quite high particularly when using naked options. I’m not saying don’t do it, just to be aware of the risks.

My Favorite Pre Earnings Strategy

Rather than holding options through earnings, I like to buy options or look at out-of-the-money diagonal spreads or calendar spreads.

A lot stock also have a tendency to rise in the lead up to earnings because of the expectation of a positive result.

This is particularly true for popular stocks like MSFT, AAPL, FB and DIS.

Here’s how I like to set up these trades:

– Look for stocks with a past history of rallying into earnings with an associated increase in implied volatility. I use CMLViz for this.

– Enter the trade roughly 10-16 days out from the earnings date

– Sell roughly 15 delta calls in the expiration immediately after the earnings date

– Buy the same number of calls in the next expiration week

– Choose the strike that is around delta 12. If that doesn’t work look for the calls that are trading for a price slightly lower than the calls you sold. This helps to minimize the risk on the downside.

– Close the trade the day before earnings.

Trade Management

For trade management, I like to keep things pretty simple and set a 30% stop loss and would also consider closing if the stock breaks through the sold call strike.

Another thing I will do, provide I can allocate more capital to the trade according to my position sizing rules is to scale in to the trade if the stock rallies.

Here’s a recent example from one of the traders in my chat room and while it’s not the exact trade, I’ve simplified it a bit to make it easier to follow:

Trade Details:

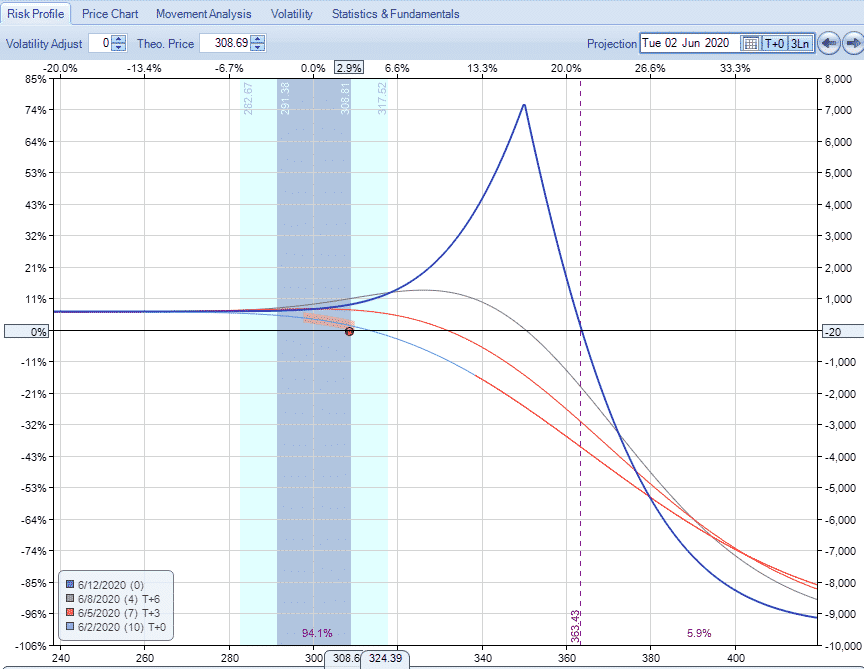

Date: June 2, 2020

Stock Price: $308.69

Trade Set Up:

Sell 10 LULU June 12th, 350 calls @ $2.70

Buy 10 LULU June 19th, 360 calls @ $2.09

Premium: $610 Net Credit

Capital At Risk: $9,390

With this trade, the worst that can happen on the downside is that both call options expire worthless and we keep the $610 in premium for a return of 6.50%.

The risk with the trade is on the upside and any big rally early in the trade will hurt.

That being said, with such a short-term trade, they usually withstand moves higher pretty well provided the stock doesn’t go above the short strike.

Looking at the payoff diagram below, notice that a 13% rally (to $340) sees the trade in a loss on days 0 to 3, but in profit of about 10% on day 6.

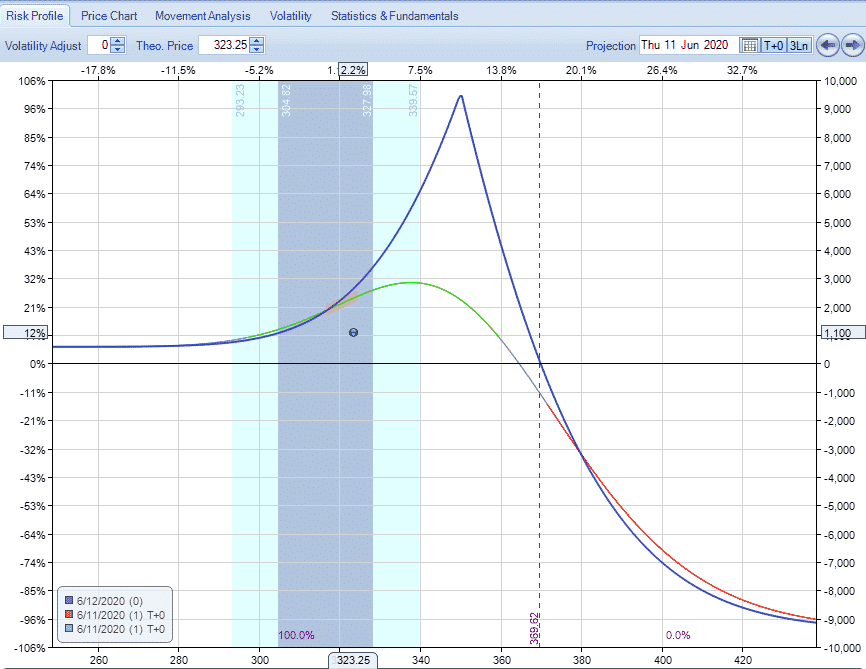

Here’s how the trade looked on the day before earnings with a nice profit of about 12%. This occurred despite the fact that the front week volatility shot through the roof and doubled while the back week only increased from 55% to 68%.

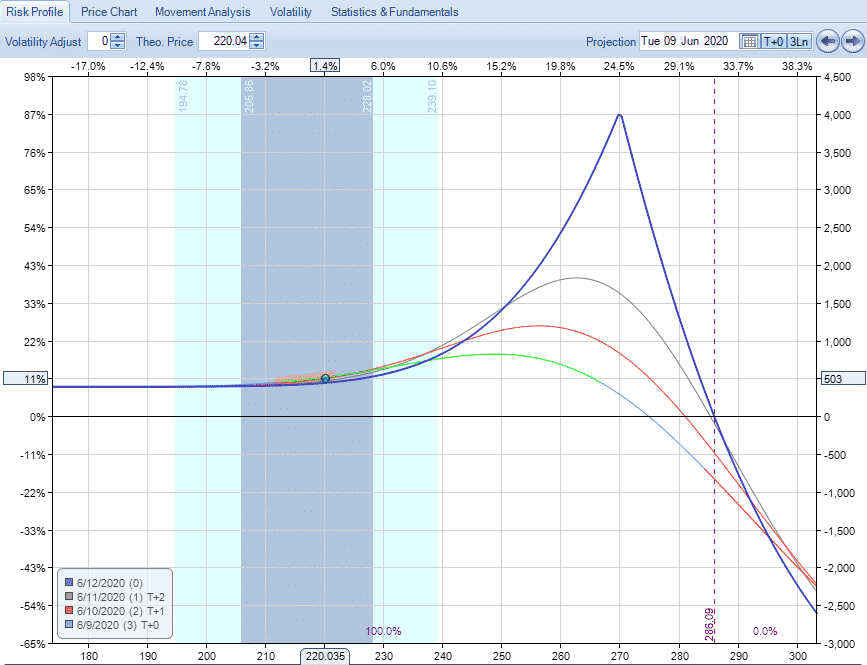

Here’s another recent example using COUP.

Trade Details:

Date: June 2, 2020

Stock Price: $233.96

Trade Set Up:

Sell 5 COUP June 12th, 270 calls @ $3.10

Buy 5 COUP June 19th, 280 calls @ $2.30

Premium: $400 Net Credit

Capital At Risk: $4,600

Very similar setup to the LULU example and a similar result for a return of $500 or 11% on capital at risk.

Conclusion

There are many ways to trade earnings with options but in my opinion the best pre earnings option strategy is the diagonal call spread.

Make sure the check the stocks implied volatility history in the lead up into earnings as well as the price action.

This is a fairly advanced strategy and is not recommended for beginners. It’s important to understand about correct position sizing before making any trade like this.

Trade safe!

P.S. The video below shows you how the trade progressed from start to finish using Option Net Explorer.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Given the high profit potential, what’s a good profit target and duration to close this trade? on the Stop Loss side. 30% of credit received. i.e. $100 credit received, you stop loss at $130 price (-$30?) do you vary this?

Hi John, I would always close out a day or two before earnings so that is your time based exit.

Stop loss is 30% of total capital at risk, not 30% of premium received.

Profit target is 20-30% as well

Thanks Gavin,

The reason for closing before earnings (Before the day of if After market), or (Before the day before if Before market Open announcement) is due to the IV crush and potential volatile move one way or the other (up – bad, down- not so bad) against this position.

Based on the P&L Profile. The Max Return is rather high at it’s peak if the stock closes at the Short Call. on the last expiry day. Is that ever achievable? 50-90% Profit Potential?

It seems like it would be good to at least receive a bit of Net Credit when opening this position to protect downside and should the underlying make a strong move down prior earnings, you could make a quick % profit on Capital risk

What would you aim for 5%-10% on Capital at Risk?

Hi Gavin,

Just did some inspection and on the P&L Graph with optionprofitcalculator, it projects possibility of near 20% at a specific stock price on the day of earnings. i’ts only beyond Earnings should the stock price remain around there should there be way higher profit potential. But, I’m guessing this is much riskier?

Hi John,

Some people hold through earnings, I prefer not too. Too risky for me, because yes you have the IV crush and risk of a big move either way. If you can get 20% out of this type of trade that’s a really good result. You would have to get pretty lucky to be right at the short call on expiration day.

Hi Gavin,

Thank you. It’s a bit hard to model using Option Profit Calculator alone as I’m not sure if just the price move (typically up towards earnings) sufficiently captures the profit/loss – since volatility is known to increase towards and is often highest prior to earnings announcement.

Do you have any suggestions – OptionNet Explorer or is IB What If Options Lab possible to model this offline (I am trading in IB right now, but find it lacking compared to what I see is available in ToS to test out strategies or I’m not using it right)

Would you recommend entering this type of trade as IV picks up closer to 10 days (as oppose to >= 15 days), in order to have higher prices (and possibly higher call option price skew) for the near month option in order to return a higher initial credit spread?

As the price rises and IV rises, it means that the 16 delta near month and 12 delta back month would be farther away which possibly means even less likely chance for the price to breach that short call (just like in an IC setup 1-2 days before earnings announcement)? But is the ideal scenario to profit from both the IV rise and a bit of the price approach during the time run up to the earnings?

Thank you

John

Hi John,

Option Net Explorer is fantastic, see my review here:

https://optionstradingiq.com/optionnet-explorer-review/

I like opening these trades around 10-15 days out.

By the way, I like your work , do you have a trading group? And, or courses?