Alibaba (BABA) is currently showing an IV Percentile of 88% which means the current level of implied volatility is higher than 88% of occurrences in the last 12 months.

That makes it a good candidate for a short volatility trade such as a short straddle of a butterfly spread.

Let’s look at an example of a butterfly spread.

A butterfly is a neutral, income-oriented strategy. It is a limited risk and limited profit trade, but on a typical butterfly trade, the profit potential is higher than the potential loss.

Butterfly spreads involve 3 different option strike prices, all within the same expiration date, and can be created using either calls or puts.

A typical butterfly would be constructed as follows:

Buy 1 in-the-money call

Sell 2 at-the-money calls

Buy 1 out-of-the-money call

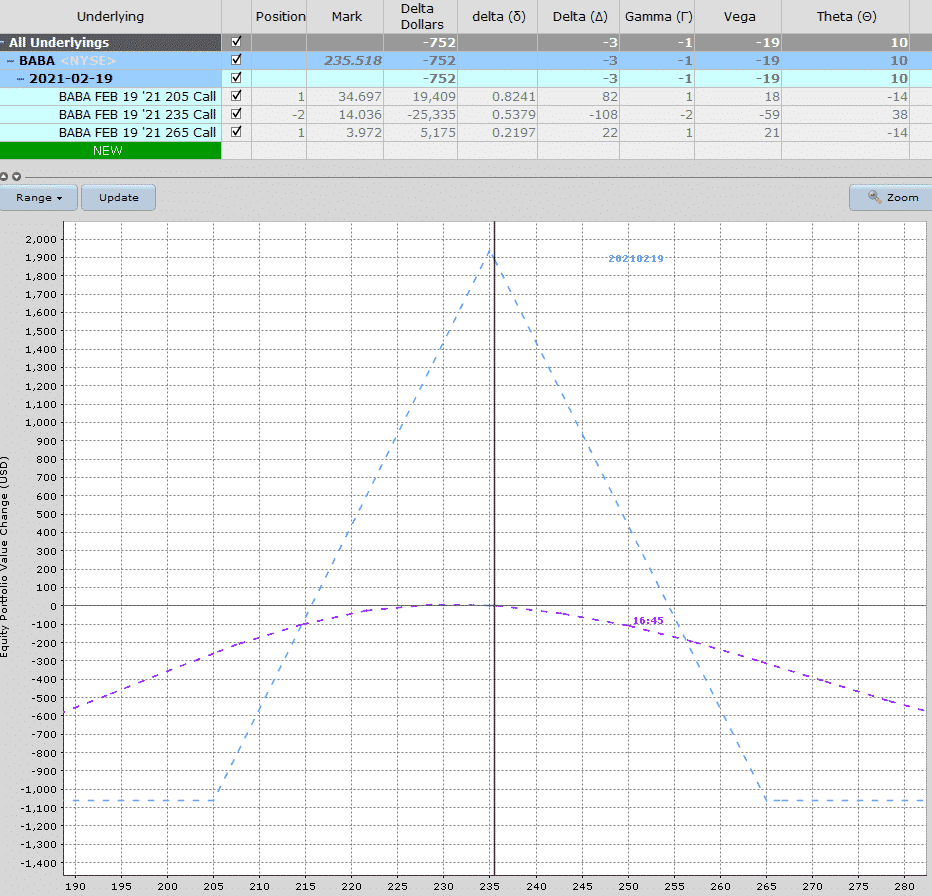

For BABA, a butterfly spread might be set up something like this:

Buy 1 February 19th 205 call @ 34.60

Sell 2 February 19th 235 calls @ 14.10

Buy 1 February 19th 265 call @ 4.00

The total cost of this trade is $1,040 and that is the maximum loss potential on the trade.

The maximum gain is $1,960 which is calculated by taking the difference in strike prices less the premium paid ($3,000 less $1,040).

The breakeven prices are 202.55 and 227.45 (215 plus and minus 12.45)

A butterfly options trade, has a tent-like shape with the potential for very large profits around the short strike. It’s important to keep in mind that it’s unlikely you would ever achieve the maximum profit.

A good aim for a butterfly trade is to make a 20% return on capital at risk. In this case that would be around $200.

I would set a stop loss or adjustment point if BABA hit either of the breakeven points which are at 215.60 and 254.40 respectively.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.